Thinking of getting Singapore Saving Bond? Read this first

All you need to know about SSB

Singapore Saving Bond or SSB is a Singapore government-issued bond. In short, SSB provides individuals with a long-term savings option that offers safe returns. In this article, we will elaborate more on SSB, to give you an understanding of what it is and if you should get it.

What is a bond?

To start things off, it would be good to have an understanding of what is bond. A bond is essentially an IOU issued by a corporate/entity. What this means is the entity is borrowing money and promising to give interest to those who signed up.

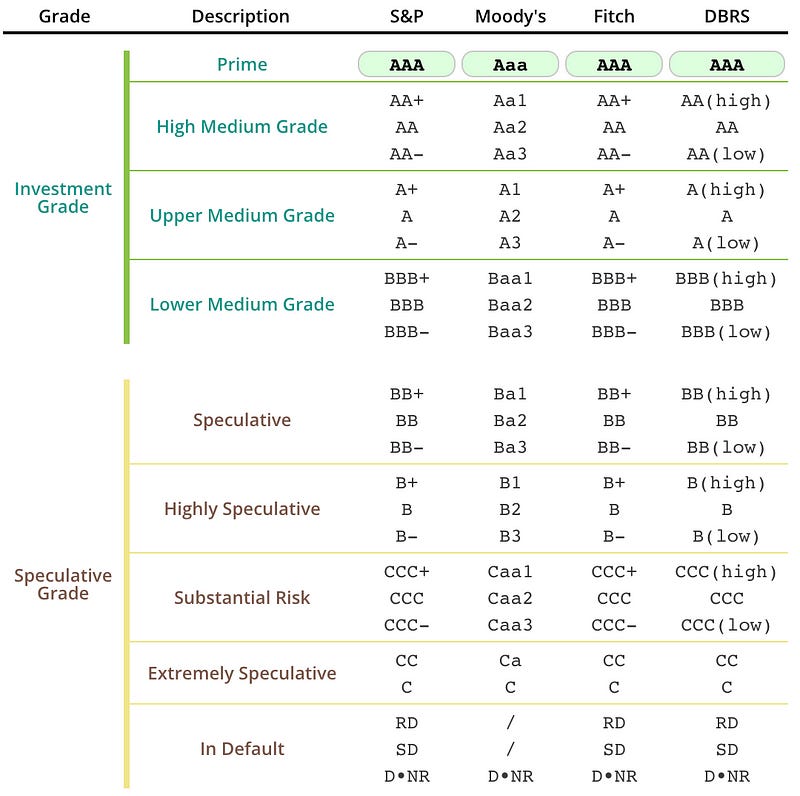

Bond credit rating

Each bond has a credit rating. A credit rating is a way to measure how likely is the issuer able to pay back the loan. For instance, if the CEO of DBS were to borrow money from you v.s. a random uncle on the street, you would more likely trust the CEO.

source: http://www.worldgovernmentbonds.com/credit-rating/singapore/

The higher the rating, the safer the bond is, usually that comes with a lower interest rate as well.

What is Singapore Saving Bond?

SSB is a bond that is fully backed by the Singapore Government. The Singapore government has the highest credit rating. What this means is the chances of losing your money from this SSB are very low. In fact, it is mentioned on the MAS website that it is capital guaranteed.

How does it work?

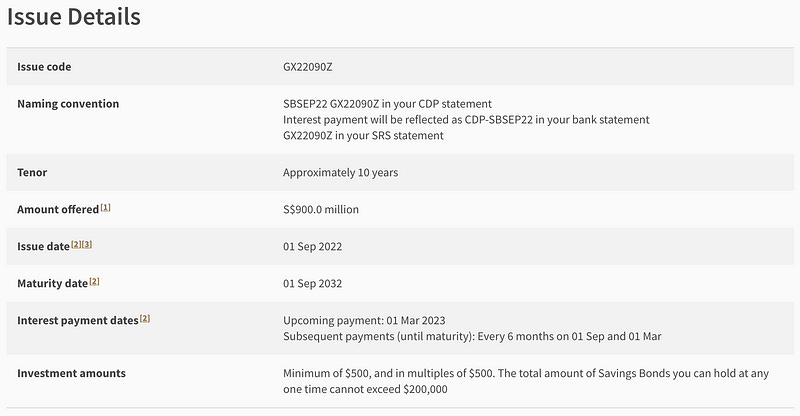

Every month, MAS will release a new SSB and the interest rate for the new issue. Each SSB has a 10-year term with step-up interest. Below is the SSB for Sept 2022

There are a few important pieces of information from the above screenshot. The interest payment dates, let you know when you can expect to receive the interest. As you can see, it pays out interest twice a year.

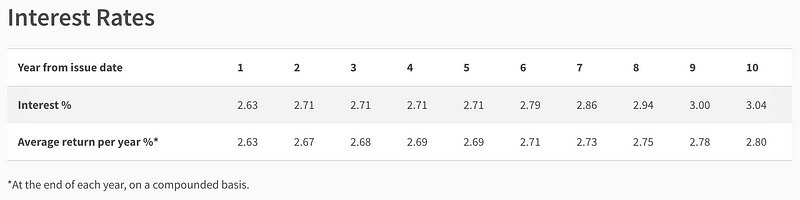

The image above shows you the interest you will be getting if you sign up for the September 2022 issue. The interest rate varies monthly for each issue. In this case, if you have invested $10,000, in the first year you would have received a total of $263, split across 2 payments. First $131.50 on 1st March 2023 and another $131.50 on 1st September 2023. In the second year, you will receive $10,000 * 2.71% = $271. ($135.50 on 1st March 2024 and $135.5 on 1st September 2024)

To get an understanding and some visual aids on the potential return you will be able to get from the SSB, check out MAS’s calculator here.

What happens when it is oversubscribed?

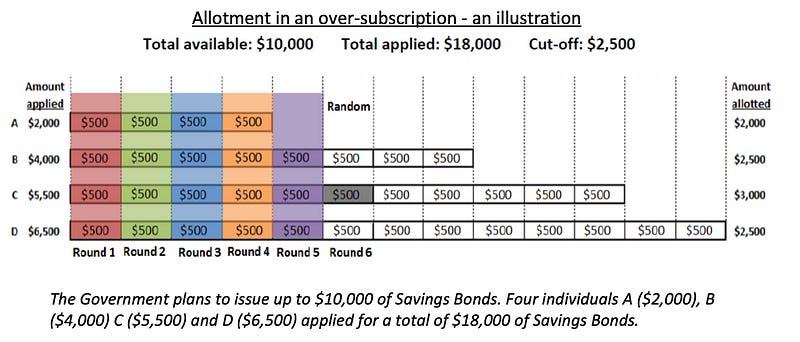

You may have noticed in the issue detail screenshot above that there is an amount offered value. What this means is that there is a limit on how much bond can be issued. When the bond is oversubscribed, the good news is, that it’s not entirely based on ballot.

As seen in the screenshot above, the rounds would be distributed to everyone equally in tranches of $500. Once the bond is not enough for everyone, the remaining rounds will be randomly assigned. You can find out more about this here.

Why consider Singapore Saving Bond?

-

Safe (Capital Guaranteed)

You will be able to get back the money you put in SSB, regardless of the economic environment. As long as our government remains sovereign. -

Flexibility

You have the ability to exit your investment in any given month. Although there’s a specific window to withdraw your investment, it is still relatively flexible compared to other investment assets out there.

Where to get SSB?

You will first have to already have a CDP or SRS account. Once you have the account set up, you will be able to sign up for SSB through DBS/POSB, OCBC and UOB internet banking portals, ATMs, and OCBC’s mobile app; or the Supplementary Retirement Scheme (SRS) or through the internet banking portal of your SRS Operator.

Is SSB worth it?

It depends on what you are looking for. If you are looking to maximize your wealth, SSB might not be the best choice for you. SSB is suitable for individuals who are looking for a safe investment asset to set aside some money. With the current interest rate given with SSB, it is rather attractive, but it might not be the case for all issuance.

**SSB as an emergency fund

**Given its safe nature, it can be used as your emergency fund. However, you can only request to withdraw your investment at a specific window of the month and receive it the following month.

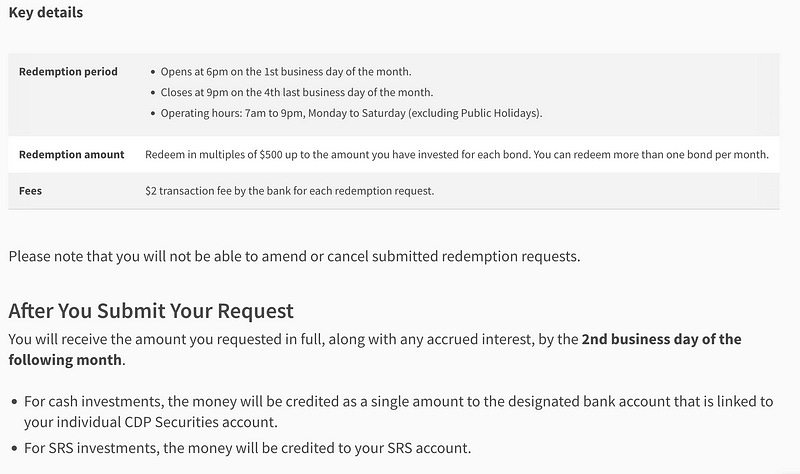

source: https://www.mas.gov.sg/bonds-and-bills/investing-in-singapore-savings-bonds/how-to-redeem

So in the worse case, if you need your emergency fund on the 3th last business day of the month, you’ll only be able to get it on the month after the following.

Conclusion

Like all assets, SSB has its pros and cons. During a bear market like this, having an annualised return of around 3% can be rather comforting. On the other spectrum, if you are looking to maximise your return, 3% may not seem much. But of course, you may opt to include it as a small element of your portfolio. At the end of the day, it depends on multiple factors, including what you are looking for.