Are Diamonds Really Valuable?

Unpacking the Sparkly Truth (and the Lab-Grown Shake-Up)

Picture this: You’re scrolling through Instagram, and another engagement announcement pops up. There’s the obligatory hand shot—perfectly manicured nails, sparkling diamond catching the light just right. Your WhatsApp groups are buzzing. “Wah, the rock so big!” “Must be at least 2 carats lah!” And somewhere in the back of your mind, you’re wondering: How much did that actually cost? And is it even worth it?

Here’s the thing nobody tells you when you’re busy calculating if you should spend two months’ salary (or is it three?) on that diamond ring: the entire diamond industry is built on one of the most successful marketing campaigns in history—and the story is way more complicated than “diamonds are forever.”

Gold engagement ring with a large central diamond and smaller side diamonds

The Uncomfortable Truth: Diamonds Aren’t Actually Rare

It turns out that the natural diamonds that get all the hype? They’re not actually that rare. The scarcity you’ve heard about? It’s manufactured. Artificial. Created by marketing geniuses working for a company called De Beers.

Back in 1888, when massive diamond deposits were discovered in South Africa, De Beers founder Cecil Rhodes had a problem: too many diamonds flooding the market would crash prices. So what did they do? They bought up mines, controlled supply, and created a monopoly that at its peak controlled 90% of the world’s diamond supply. They literally stockpiled diamonds to keep them “scarce”.

But here’s where it gets really interesting. In 1947, De Beers hired an advertising agency and came up with the most iconic slogan in marketing history: “A Diamond is Forever”. Before this campaign, only 10% of brides in America received diamond engagement rings. By the end of the 20th century? Over 80%. They didn’t just sell diamonds—they sold the idea that you’re a failure if you don’t buy one.

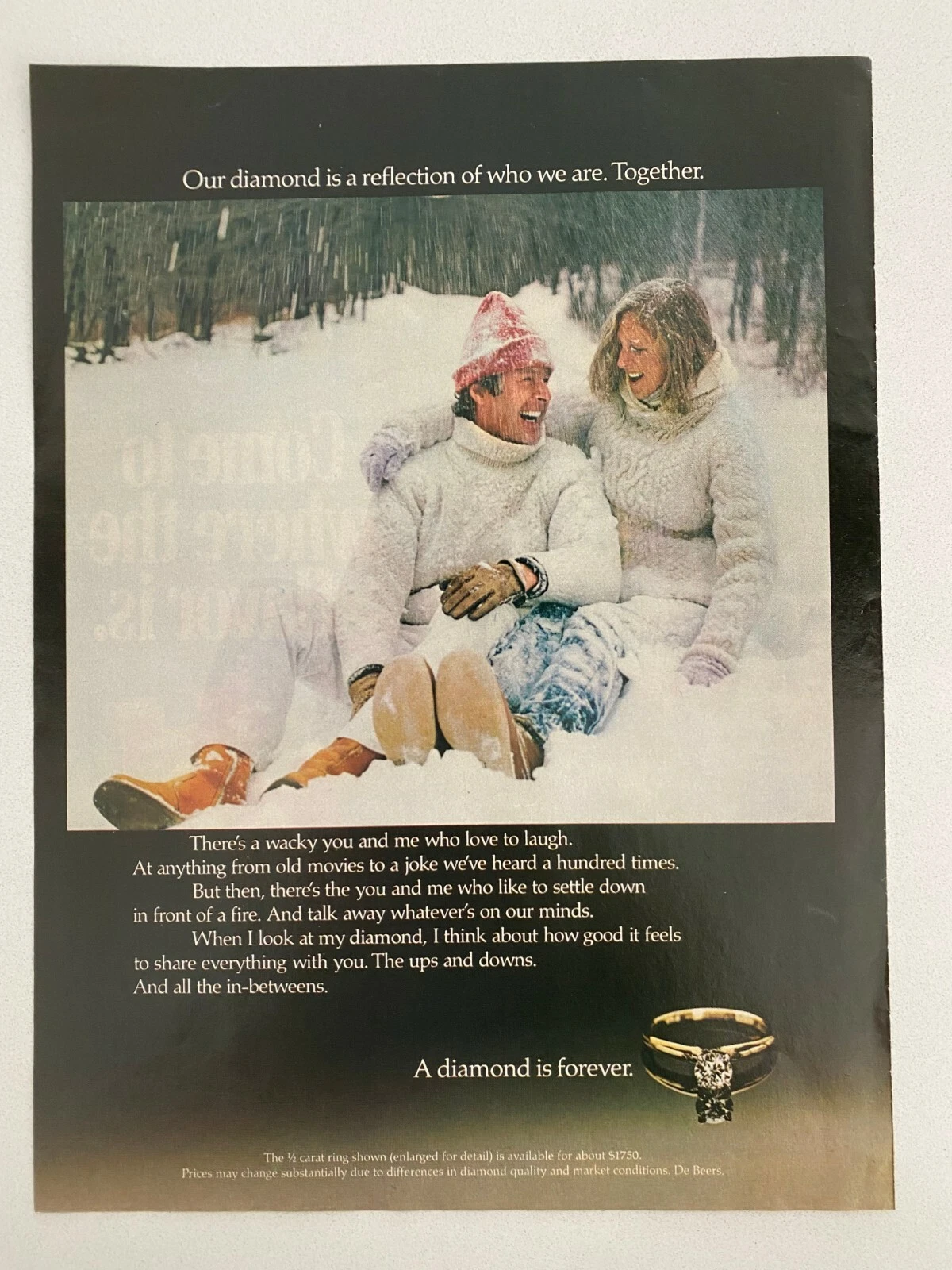

Vintage 1979 De Beers ad emphasizing the emotional and enduring value of diamonds as symbols of love.

Vintage 1979 De Beers ad emphasizing the emotional and enduring value of diamonds as symbols of love.The campaign was so effective that it convinced entire generations that:

- Diamonds are the only acceptable engagement ring stone

- The size of your diamond reflects the depth of your love

- You should spend a specific portion of your salary on it (they started with one month, then upped it to two, then three)

- Diamonds hold their value over time

Spoiler alert: Most of these are myths.

The Reality Check: What Happens When You Try to Sell Your Diamond

Remember that $10,000 diamond ring you bought? Here’s the painful truth about what happens when you try to sell it.

The moment you walk out of the jewelry store, your diamond loses 30-60% of its value. Yes, you read that right. It’s like buying a new car, except worse. That $10,000 ring? You might get $3,000-$6,000 from a jeweler, or $2,000-$4,000 from a pawn shop.

Why such a brutal drop? Let’s break down the diamond pricing chain:

- The manufacturer creates the diamond and sells it to a wholesaler

- The wholesaler adds their markup and sells to a retailer

- The retail jeweler doubles or even triples the price to cover rent, salaries, marketing, and profit

- You buy it at full retail price

- When you sell, buyers only care about the actual diamond value—not all those markups you paid

Enter the Disruptor: Lab-Grown Diamonds

Now, here’s where things get really interesting and where the traditional diamond industry starts sweating.

Lab-grown diamonds burst onto the scene as a budget-friendly alternative. And here’s the kicker: they’re chemically, physically, and optically identical to natural diamonds. Same carbon structure, same hardness (10 on the Mohs scale), same sparkle. Even trained gemologists need specialised equipment to tell them apart.

![Both natural and lab-grown diamonds share the same chemical composition, hardness, and refractive index.][image2]

Both natural and lab-grown diamonds share the same chemical composition, hardness, and refractive index.

How Are Lab-Grown Diamonds Made?

There are two main methods:

1. HPHT (High Pressure High Temperature):

- Mimics how diamonds form naturally in the Earth’s mantle

- Subjects carbon to extreme pressure (5-6 GPa) and heat (1,300-1,600°C)

- Takes days to weeks to grow

- Popular in China, which produces 46% of the world’s lab diamonds.

2. CVD (Chemical Vapor Deposition):

- Uses carbon-rich gas (usually methane) in a vacuum chamber

- Gas breaks down and deposits carbon atoms layer by layer on a diamond seed

- Takes several weeks to grow larger stones

- More common in India, which produces 26% of global lab diamonds

- More energy-intensive than HPHT, requiring temperatures up to 1,500°C

The Price Collapse Nobody Saw Coming

In 2016, a 1-carat lab-grown diamond cost about 16% less than a natural diamond. By 2025? Lab diamonds are 80-90% cheaper than natural diamonds.

That’s right—lab diamond prices have crashed by 85% in just a few years. Some analysts predict they could drop further as production continues to scale up in China and India.

Why Did Lab Diamond Prices Collapse?

The answer is simple: unlimited supply meets manufacturing efficiency.

Natural diamonds take billions of years to form and are limited by geology. Lab diamonds? They can be produced continuously in factories. China and India have built massive production capacity, and there’s theoretically no limit to how many they can make.

This is the fundamental flaw in lab diamonds as an investment: When something can be mass-produced indefinitely, it becomes a commodity, not a luxury good. And commodities follow the rules of supply and demand—when supply explodes, prices crash.

The Environmental and Ethical Angle

Now, before you think lab diamonds are the perfect solution, let’s talk about the complicated reality.

The Good News:

- No land excavation or habitat destruction

- Significantly less water usage (up to 127 gallons per carat for mined vs. minimal for lab-grown)

- No mining waste or toxic tailings

- Transparent supply chain with no conflict diamond concerns

The Not-So-Good News:

- Lab diamond production is extremely energy-intensive

- Creating a 1-carat lab diamond can consume over 250 kWh (vs. up to 500 kWh for mined)

- China produces 46% of lab diamonds, and 62% of their electricity comes from coal

- India produces 26% of lab diamonds, and 74% of their electricity is coal-based

A Nature study found that if produced with renewable energy, lab diamonds could reduce annual greenhouse gas emissions by 9.58 million tonnes and mineral waste by 421 million tonnes by 2100. But right now? Most lab diamonds have a significant carbon footprint because they’re produced in coal-dependent regions.

The FTC actually warned several lab diamond companies in 2019 for advertising their products as “eco-friendly” and “sustainable” without being able to substantiate those claims.

So… Are Diamonds Really Valuable?

Here’s my honest take, minus the marketing BS:

Natural diamonds have value, but not for the reasons you think.

They’re not valuable because they’re rare (they’re not that rare). They’re not valuable because they’re a good investment (they’re terrible for most people). They’re valuable because:

- Cultural programming works: Decades of marketing have convinced us they symbolize love and commitment

- They’re tangible and portable: Unlike stocks, you can hold a diamond and take it anywhere

- The system perpetuates itself: As long as people believe diamonds are valuable, they maintain demand

Lab-grown diamonds offer beauty without the price tag—but they’re not investments either.

They’re perfect if you:

- Want a bigger stone for less money

- Care about avoiding mining impacts

- Understand you’re buying jewelry, not an asset

They’re not for you if you:

- Want something that holds resale value (it won’t)

- Value rarity and natural formation

The Daretofinance Take: What Should You Actually Do?

Look, we’re not here to tell you what to do with your money. That’s your 98 cents, remember? But here are some thoughts:

If you’re buying an engagement ring:

- Be honest about what you’re buying: You’re buying a symbol and a piece of jewelry—not an investment

- Don’t spend two months’ salary: That “rule” was literally invented by marketers. Spend what makes sense for your financial situation

- Consider lab-grown if budget matters: Get a bigger, better-looking stone for a fraction of the price

- Buy from reputable sources: Whether natural or lab, get proper certification (GIA, IGI)

- Don’t expect to recoup costs: If you’re planning your exit strategy before buying the ring, maybe reconsider the relationship first

If you’re thinking about diamonds as an investment:

- Don’t: Unless you’re already wealthy and diversifying exotic assets

- Consider alternatives: Gold has better liquidity and price transparency

- If you must: Focus on fancy colored diamonds or truly exceptional stones with proper documentation

If you’re trying to sell inherited diamond jewelry:

- Get multiple appraisals: Don’t rely on just one buyer’s offer

- Understand you’ll lose money: Expect 20-60% of retail value at best

- Branded jewelry helps: Tiffany, Cartier, etc. hold value better

- Timing matters: Natural diamond prices have been relatively stable recently

The Bottom Line

Diamonds are beautiful. They’re meaningful. They’re culturally significant. But they’re not the guaranteed store of value that a century of marketing has convinced us they are.

Whether you choose natural or lab-grown, buy with your eyes open. You’re paying for beauty, symbolism, and perhaps some emotional value—and that’s perfectly fine. Just don’t fool yourself into thinking you’re making an investment.

The most valuable thing about a diamond isn’t its resale price or its geological origin. It’s the meaning you attach to it and the memories it represents. And that value? It’s entirely up to you to decide.

That’s our 2 cents. The other 98 cents? As always, that’s up to you.