Are you investing in S&P 500? Consider this.

Why Singaporeans should consider an Irish Domiciled S&P 500

The S&P 500, representing 500 of the largest U.S. publicly traded companies, is a popular choice for investors worldwide. However, for Singaporean investors or non-US resident, there’s an added layer to consider: the domicile of the fund.

aka the country in which the fund’s holding company is legally incorporated, and where the administration and management of the fund is done.

Understanding this can greatly impact your tax efficiency and overall investment goals. Stick around as we unpack why opting for an Irish Domiciled S&P 500 could be a smart move for you.

What does Irish Domiciled S&P 500 mean?

An “Irish Domiciled S&P 500” is an ETF that tracks the performance of the S&P 500 index, but unlike the typical S&P 500 ETFs that are based in the United States, this one is domiciled in Ireland. In simple terms, it’s registered, regulated, and managed in Ireland. Why does this matter for a Singaporean investor? The reason lies primarily in tax efficiency, which we will discuss next

So why does that matter?

Tax Efficiency: Save More of Your Dividends

A key benefit of considering an Irish Domiciled S&P 500 ETF is its advantage in terms of tax efficiency. Normally, ETFs domiciled in the U.S. impose a 30% withholding tax on dividends for non-residents. So, if you earn a US $100 dividend, you’re left with US $70 after a $30 tax deduction.

Here’s where the Irish Domiciled ETF shines. Thanks to a tax treaty between Ireland and the U.S., the withholding tax for dividends is halved to just 15%. That means, for every US $100 dividend, you lose only US $15, saving $15 that would otherwise go to taxes. For Singaporean investors, this could translate to significant long-term tax savings.

Where to Buy Irish Domiciled S&P 500 ETFs?

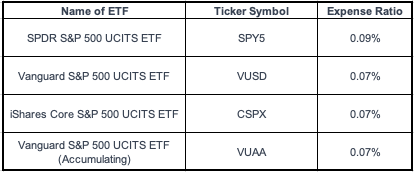

You can find the Ireland Domiciled ETF on the London Stock Exchange. Here are some of the more common Irish Domiciled S&P 500 ETF:

Brokerages

In Singapore, not all brokerages can give you access to the London Stock Exchange. ProsperUs is one of the few that can provides access.

ProsperUs is a digital investment platform based in Singapore, regulated by Monetary Authority of Singapore (MAS). It offers users the capability to invest in multiple asset classes across various global markets, including London Stock Exchange.

If you are new to ProsperUs, they currently have a welcome bonus of $120 for new sign-ups. Additionally, when you register through our specific link, you’ll be entitled to an extra $20 cash credit, enhancing your initial investment potential.

ProsperUs: A Gateway to Irish Domiciled ETFs

ProsperUs is one of the few digital investment platforms based in Singapore that provides access to the London Stock Exchange. Regulated by the Monetary Authority of Singapore (MAS), it offers a wide range of global investment options. If you’re new to ProsperUs, there’s currently a $120 welcome bonus for new sign-ups. Additionally, registering through our specific link will entitle you to an extra $20 cash credit.

Disclosure: We may receive a small commission for sign-ups made through our link.

Conclusion

If the S&P 500 is on your investment radar, considering an Irish Domiciled ETF can be a game-changer in terms of tax efficiency. For Singaporean investors, this can mean more money in your pocket and a smarter approach to growing your wealth.