Can A Single Buy A House In Singapore: Your Complete Guide

Wish to buy a house in Singapore as a single? Find out what are your options, grant amounts & more here.

Embarking on the journey of buying a house as a single person in Singapore can be exciting yet overwhelming.

But, is it still possible with the current landscape of rising interest rates, high housing prices, and a competitive market?

Let’s explore the various options available when buying a house in Singapore as a single.

Buying A House In Singapore As A Single: HDB Flat Or Private Property

Before you begin, you must first decide whether to get an HDB flat or private property.

There are three main options to choose from:

-

HDB BTO and resale flats

-

Executive Condominiums (ECs)

-

Private condos and landed properties

If you decide to purchase an HDB flat, you must be 35 years old and above (for unmarried or divorced) or 21 years old and above (for widowed or orphan). Also ensure you’re within the Ethnic Integration Policy (EIP).

Types Of HDB Flats Singles Can Buy In Singapore

Singles can buy BTO flats or resale flats under the

-

Single Singapore Citizen Scheme: For individual applicants

-

Joint Singles Scheme: Joint ownership for up to 4 singles, with a minimum of 2

Next, you must choose which type of HDB flat you’re getting — BTO or resale.

Option #1: BTO Flat For Singles In Singapore

Applying for a BTO flat is the cheapest option out of all.

For singles who choose a BTO flat, you can buy a 2-room Flexi flat in non-matured estates (Woodlands, Bukit Panjang, Sengkang, Punggol, Tengah, etc.). Only those with a gross monthly income of less than S$7,000 may apply for a BTO flat.

Pros

-

Cheapest option compared to resale flats and private properties

-

Fresh 99-year lease

Cons

-

Income ceiling of S$7,000

-

Smaller-sized flat in a non-mature estate*

-

(From H2 2024, there would be no such restriction, you can purchase from all locations- Standard Prime and Plus)

-

Longest process compared to resale flats and private properties

Option #2: Resale Flat For Singles In Singapore

Another option is purchasing a resale HDB flat from the open market, which has fewer restrictions.

Ensure that the property you purchase has at least 20 years of lease remaining and the remaining lease can last until the youngest applicant (or yourself, if applying alone) reaches 95 years old.

Failure to meet these requirements will affect the Loan-to-Value (LTV) limit for your HDB loan and use of CPF funds.

Pros of resale flat

-

No income ceiling of S$7,000, but the ceiling still applies to certain grants

-

More flexibility to buy any flat type beyond the 2-room Flexi BTO flat

(except for prime location) -

Can get your house faster than 2-room Flexi BTO flats

-

Cheaper option compared to private properties

Cons of resale flat

-

More expensive compared to 2-room Flexi BTO flats

-

Varying degrees of lease decay

-

Prime location limited to 2-rooms flexi

(from H2 2024 onwards)

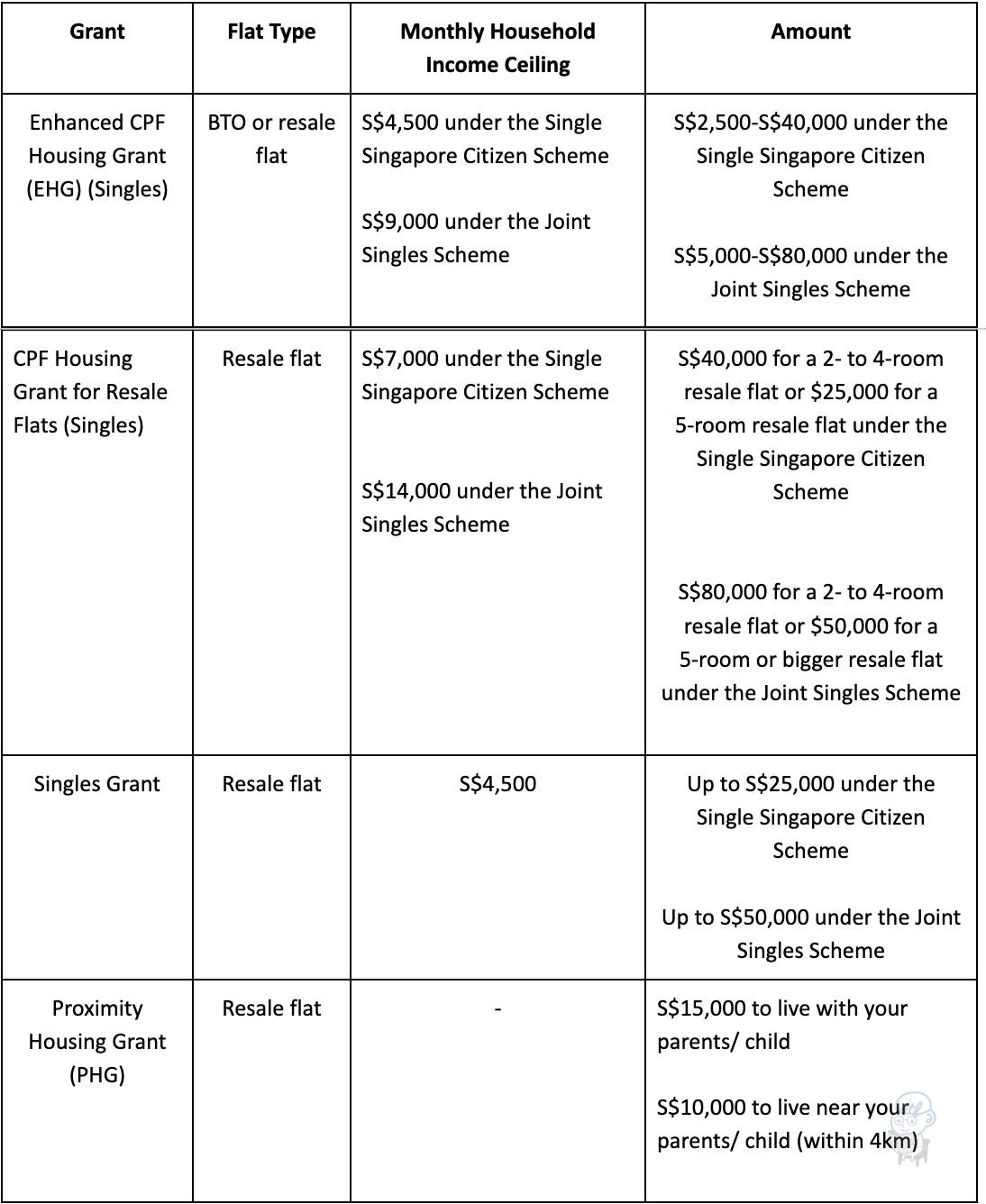

Grants Under Single Singapore Citizen Scheme & Joint Singles Scheme

Worried that your monthly income is not enough to afford a flat as a single in Singapore? Don’t fret, you may be eligible for grants. The total grant amount varies based on your monthly income and the type of house you are purchasing.

For those applying under the Joint Singles Scheme, you can also qualify for higher grant amounts.

Executive Condominium (EC) For Singles In Singapore

Wish to have a house with condo facilities? Currently, the Joint Singles Scheme is the only way for singles to purchase an executive condominium (EC) unit. Your total gross monthly income must also be less than S$16,000. Unfortunately, you will not be eligible for any CPF housing grants as a single buying an EC in Singapore.

Singles who wish to purchase an EC unit on their own can look at those on the resale market.

Pros of EC

-

Enjoy condo facilities

-

Healthy appreciation as it’s cheaper than private property yet still can enjoy private property status after 10 years

-

Fresh 99-year lease

Cons of EC

-

Must apply for EC under the Joint Singles Scheme

-

Can only take a bank loan, limiting your borrowing to a maximum of 75% of the purchase price

-

No housing grants provided

-

More expensive option compared to HDB flats

Private Property For Singles In Singapore

Condo, terrace, or bungalow — your choice. The private property market is the most expensive option but allows you the greatest flexibility.

Pros of private property

-

Can buy your house before 35 years old as a single in Singapore

-

Greater flexibility in the type of house you wish to have

Cons of private property

-

Most expensive option with a higher cash outlay

-

Can only take a bank loan, limiting your borrowing to a maximum of 75% of the purchase price

When buying a private property, a mandatory cash component of 5% is required for the downpayment, while the remaining 20% can be paid in cash, CPF OA, or a combination of both.

Before proceeding with your purchase, it’s advisable to obtain an In-Principle Approval (IPA) to confirm your eligible home loan amount.

Eligibility for a bank loan is based on your employment and income. The Total Debt Servicing Ratio (TDSR) framework sets a limit on the monthly home loan instalment, ensuring it does not exceed 55% of your monthly income after deducting any debt obligations. The bank will calculate the loan amount based on the maximum monthly instalment you can afford.

How Much Should You Be Earning to Buy A Private Property As A Single

Assuming you’re buying a 1-bedroom plus study unit alone at The Myst that was recently launched. These units start from S$998,000.

The downpayment will be S$249,500 (25% of the property price), out of which S$49,900 (5%) must be paid in cash. The remaining S$199,600 (20%) can be paid using cash or your CPF Ordinary Account (OA) savings.

Assuming you’re financing this property with a bank loan at an interest rate of 4% over 30 years, your loan amount would be S$748,500 (75% of the property price). This would result in a monthly instalment of approximately S$3,571.

Under the TDSR framework, you must then be earning at least around S$6,493 to afford a 1-bedroom plus study unit at The Myst.

Keep in mind that these calculations do not take into account additional costs, such as Buyer’s Stamp Duty (BSD), legal fees, and home insurance.

Other Hidden Costs When Buying A House As A Single In Singapore

Since we’re on the topic of costs, remember to consider the hidden expenses associated with owning a house, whether you’re buying an HDB flat, EC, or private property as a single in Singapore.

These expenses go beyond the mortgage payments and can significantly impact your overall budget! Here are some key hidden costs to take into account:

-

Moving in expenses

-

Furniture and appliances

-

Property taxes

-

Legal fees

-

Maintenance and repair fees

-

Utility & broadband costs

-

Town Council/MCST fees

-

Home insurance

By setting aside enough cash for them, you can ensure that you have a realistic understanding of the total financial commitment involved in homeownership.