Can you really profit from BTO?

A closer look into the recently MOP BTO projects

Many Singaporeans dream of getting their own home, for many it starts after BTO. Build-To-Order (BTO) flats first started in 2001 as a way to introduce affordable new flats at a subsidised price to Singaporeans. These flats are often sold at a “discounted” price which makes it a good opportunity to buy and profit later. In fact, 13.4% of the BTO flat were sold within just a year after MOP, double the amount since 2016.

With all the measures put in place to discourage people purchasing purely to profit or curb the lottery effect, can you really profit from BTO? To answer this question, we analysed over 12 BTO projects that have just reached its Minimum Occupancy Period (MOP) period in 2021 and 2020. If you are looking to profit from the purchase of a BTO , do read on.

Disclaimer: This is by no means a comprehensive analysis as only a small sample of BTO projects were included in this comparison. On top of that, the past performance of property prices do not guarantee the future price of the BTO projects.

How much discount do you get from BTO?

Yes, BTO flats are sold at a cheaper price. But do you know how is the price determined? Before we dive into it, here’s a fun fact: HDB’s BTO flats are often sold at a loss and this is reflected in HDB’s audited financial statement.

TLDR; HDB assesses the market value of comparable resale flat nearby and apply significant subsidy so that new flats are always priced below the market. You can read more about it here.

What this means is (from my own interpretation), the primary objective is to ensure that the flats are affordable. As such, different projects or even types of flats are possibly subsidised at a different rate as long as they are deemed to be affordable.

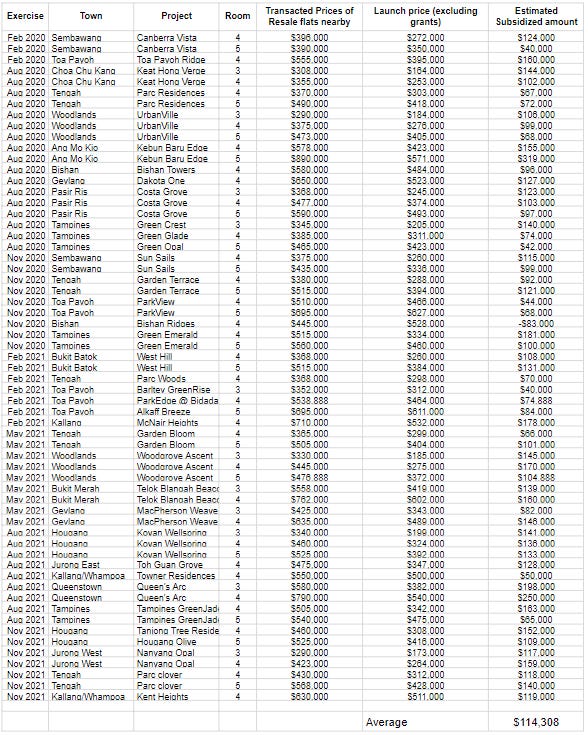

In the table we’ve compiled below, you can see the subsidised amount which is the difference between the “Transacted prices of resale prices nearby” and “Launch price”.

To find out how much BTO flats are subsidised, we collected data from BTO projects over 2020 and 2021. All this information are collected directly from the HDB website, you can see a sample of the original table from one of the BTO sales launch here.

Based on the information you see from this table, you can tell that not all BTO flats are equally subsidised. Some flats get a lot more subsidies than others. For example, in the Ang Mo Kio’s Kebun Baru Edge project in August 2020, subsidies were about $319,000 for a 5-room flat. On the other hand, we have the Bishan Ridge project in Nov 2020 that was priced at a higher price of $83,000 more than the Transacted Price of nearby flats (you can check out the prices of the surrounding flats here). Well, this is definitely an unusual sighting for BTO projects to be more expensive than the surrounding resale transactions. Perhaps the HDB board have taken another set of surrounding flat as a comparison. But the main taken away here is, not all BTO are subsidised equally.

Based on the past 2 years of BTO projects, you can see that on average BTO are around $120,000 cheaper than the surrounding flat price.

On top of that, with the HDB staggered down payment scheme and the grants available, BTO flats are really very affordable. Thanks, Singapore. #notsponsored

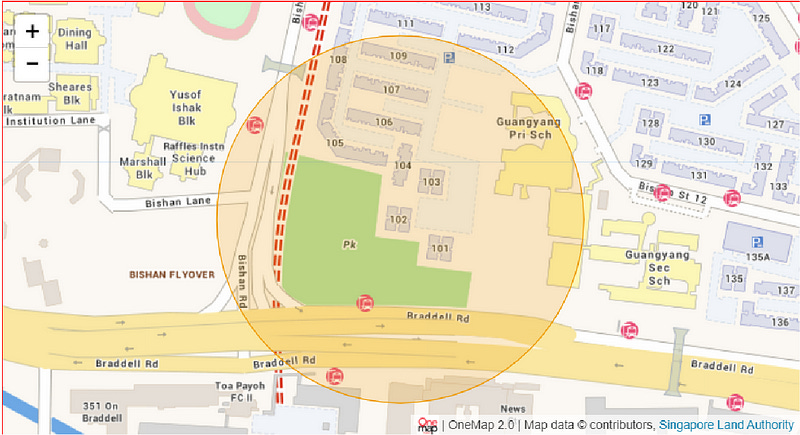

Understanding the transacted prices of resale flats nearby

If you are alarmed at how the Bishan Ridge project in Nov 2020 was priced higher than the surrounding resale flats, you will need to understand how we derived the “Transacted Prices of Resales Nearby”. Transaction prices of surrounding flats within 200m can be found here. These transaction prices are merely historical records of the prices of flats around that area. It is heavily affected by variables such as remaining lease, quality of flat etc. On top of these, there is also a possibility that the flat on lower bandwidth of the transactions is an outlier. Since we utilised the lower bandwidth of the transactional price given by the HDB portal, we could be understating the actual cost of the resale price. Because of that, it might affect the accuracy of the conclusion. Nevertheless, it should still be sufficient information to get a hint of how much BTO projects are subsidised.

Profits after MOP?

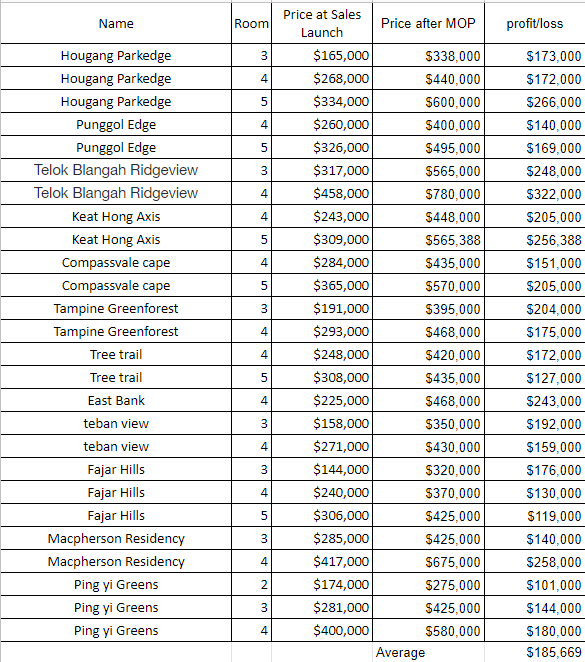

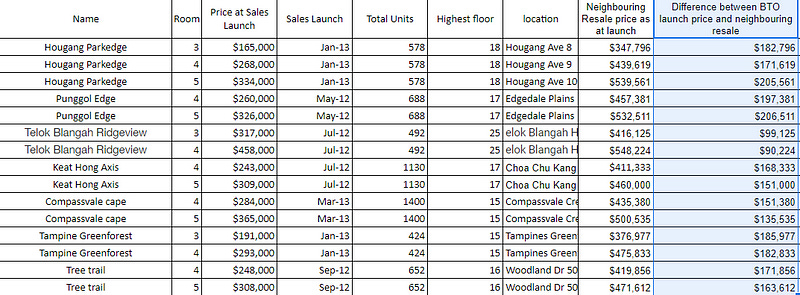

Next, to find out the potential profit one could get after reaching the MOP period. We have to analyse the BTO projects that have just met their MOP. As such, we collected the sales launch data for over 12 BTO projects that MOP in 2020 and 2021 and collected the latest resale transactions for the respective projects on the HDB website. In an attempt to make it a fair and more conservative analysis, we used the lowest bandwidth prices for the “Price at sales launch” and “Price after MOP” wherever possible.

From the data above, all BTO projects ended up in a profit. In other words, homeowners were able to sell their BTO homes at a higher price than when they had purchased them. On average, a BTO project that has just reached its MOP can expect a profit of around $185,669. This amount seems reasonable to me, considering that the BTO was sold at around $120,000 in discount and coupled with the appreciation of the property market after 10 years (assuming 5 years in the building time period and 5 years till MOP).

It is worthy to note that not all BTO projects are equal. From these 12 BTO projects, you can see that there are projects that have appreciated more than $300,000 while there are others that only profited slightly more than $100,000. Considering the 10-year wait, just $100,000 may not seem worth it. Once again, because of how transaction prices are determined, it can be difficult to provide an accurate estimate of the actual profit from a MOP.

If you are observant enough, you may have noticed that the Sales price of these projects seems to also be much cheaper. And yes, from the data that we gathered, these projects seem to have slightly more subsidies than the recent projects. We were unable to find the neighbouring resale transactions for the year 2012 for all the BTO projects that we listed here, but among those that we could, you can see that the prices were about $150,000 to $200,000 cheaper back then. Yikes, INFLATION IS REALLLLL!

MOP flat v.s. Resale flat

Before you jump into getting a BTO, let’s take a closer look at the resale flat market. Although, yes BTO will likely yield you some profit. But if a resale flat can yield similar profit, then BTO might not be exactly worth it. To explore this, we will look into 2 case studies — Punggol and Fajar Road.

Case Study: Punggol

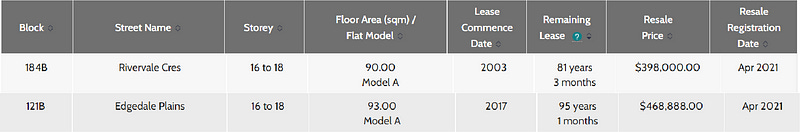

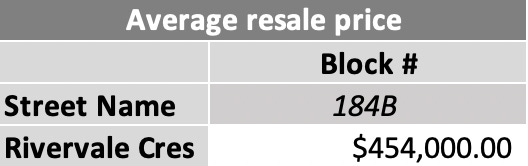

The 2 images above illustrate the difference between a resale flat (Rivervale Cres) and a BTO Punggol Edge on the street (Edgedale Plains). Looking at this case study at Punggol, we can see that the prices of resale depreciate from $454,000 to $398,000. While the price of the BTO project in 2012 appreciate when it reaches MOP, leaving it to a profit of around $200,000.

Case Study: Fajar Road

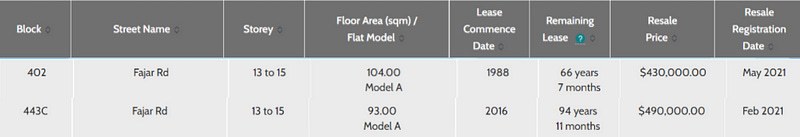

In another case study for the flat at Fajar road, we can see that the property in that area has both appreciated. In the first image, is the latest transaction price for both the BTO that recently MOP (block 433C) and the resale flat (Block 402).

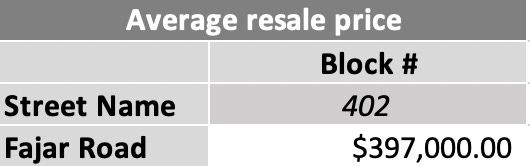

The resale flat appreciated from $397,000 (from the 2nd image) to $430,000 (the first row of the first image). But since BTO flats are bought at a cheaper price, you would be sitting on a profit of around $250,000 for this case study.

Outcome: BTO v.s. MOP

From these two case studies, you can see that a resale flat doesn’t always mean that you will lose money. There are also cases where the resale value appreciates at price. So if you are just looking at places to stay resale price ain’t a bad idea at all.

Conclusion

The findings we have is definitely not enough to draw a conclusion as to whether you can definitely profit from a BTO. But we hope that from these data you are able to get some interesting insights and have some food for thought before joining the rest of the crowd in this lottery process.

Ultimately, BTO is meant to keep homes affordable for all Singaporeans and not for “flipping” them for profits. But if you have the time and patience to wait, BTO might be worth a try.