Essential Insurance you need to have

Important insurance that you should consider when you graduate

Alright, so you’ve tossed your graduation cap into the air, and now real life is knocking on your door. One of the first grown-up things you’ve got to think about? Insurance. I know, it sounds super adult-ish and maybe a tad boring, but trust me, it’s essential. Let’s break it down.

1. Hospital Insurance

TDLR; Medical bills in Singapore? They can add up pretty easily. So as we always say, hospital insurance’s the most essential and a must-MUST-get, covering those unexpected hospital stays and treatments.

More details:

In Singapore, the hospital insurance is made up of two components — Medishield Life and Integrated Shield Plan.

Medishield Life

MediShield Life is a basic health insurance plan designed to protect all Singapore Citizens and Permanent Residents (PR) against hefty hospital bills for life. Yep, you read that right – for life! This means that regardless of your age or any pre-existing health conditions, you’re covered.

It is also compulsory for all Singapore citizens and PR. MediShield Life is tailored for subsidised treatments in public hospitals, specifically for B2/C-type wards.

However, though, there are many limitations to what Medishield life can provide. Especially if you would prefer a fancier ward like A/B1-type ward or private hospital.

Integrated Shield Plan

What if you want more than just the basics? Enter the Integrated Shield Plan (IP). The IP is like upgrading your phone to have more features and better performance. It enhances your basic MediShield Life coverage, giving you the option to stay in better hospital wards or even private hospitals without burning a hole in your pocket.

Now, here’s where it gets a tad more detailed:

-

Main Component of IP: Think of this as the premium version of MediShield Life. It’s designed to give you more extensive coverage, and the good news is, you can use your MediSave to pay for it. Imagine having a basic phone and then opting for a data plan to supercharge its capabilities. That’s what the IP does for your MediShield Life. With an IP, you’re typically responsible for two parts of the hospital bill: the deductible and co-insurance. The deductible is like an initial fee you cover before your insurance kicks in. Co-insurance, on the other hand, is your share of the remaining bill, usually around 10%.

Breaking Down a $10,000 Bill with IP Coverage in an A Ward:

-

Deductible: $2,500

-

Co-Insurance: ($10,000 - $2,500) x 10% - $750

-

Total Out-of-Pocket: $2,500 + $750 - $3,250

-

Covered by Insurance: $6,750

Now, here’s the catch. That 10% co-insurance can be a bit daunting, especially since it doesn’t have a maximum limit. And about the deductible? If your bill is less than the deductible amount, you won’t be able to make a claim. So, it’s essential to be aware and plan accordingly.

-

-

Rider: This is an add-on to your IP. It’s akin to opting for an unlimited data plan, ensuring you never have to stress about data overages.

The rider simplifies your insurance claims. Instead of juggling multiple costs, you just cover 5% of the bill. And here’s the cherry on top: that 5% you pay? It’s usually capped at $3,000, no matter how big the bill.

So, referring back to our $10,000 bill example, with a rider, your share drops to just $500. That’s a whopping 85% reduction in what you’d typically pay out-of-pocket! But remember, while the rider offers fantastic savings, you can’t tap into your MediSave to pay for it. It’s a cash-only deal.

2. Critical Illness Insurance

TDLR; This one’s a lifesaver. If you get diagnosed with a serious illness, this insurance gives you a cash payout. It’s like a financial cushion when you need it most and give you assurance to take time off work.

More details:

In the hustle and bustle of life, health can sometimes take a backseat. But when critical illnesses strike, it’s not just your health that’s impacted; your finances can take a hit too. That’s where Critical Illness Insurance comes into play.

The Freedom to Recover

The primary purpose of Critical Illness Insurance is to give you a lump sum payout when you’re diagnosed with a severe illness. Think of it as a financial cushion. With this payout, you have the freedom to take a break from work, focus on your recovery, and not worry about where the money’s coming from. It’s like having a safety net that ensures you don’t fall too hard.

How much coverage do you need?

A good rule of thumb is to aim for coverage that’s 3 to 5 times your annual income. Why? Well, it’s like giving yourself the ability to pause work for 3 to 5 years if needed. If you earn $50,000 a year, imagine having $150,000 to $250,000 set aside just for your recovery. Sounds reassuring, right?

Early v.s. Late Stage Critical illness coverage

When diving into the details of Critical Illness Insurance, you’ll come across terms like ‘early stage’ and ‘late stage’. Let’s break that down:

-

Early Stage Coverage: This covers you right from the initial stages of a critical illness. For instance, if a medical test hints at the early onset of a disease, this coverage kicks in. It’s like catching a problem when it’s just a tiny leak, allowing you to fix it before it becomes a flood.

-

Late Stage Coverage: This is for when the illness is more advanced and has progressed to a severe stage. Think of it as insurance stepping in when that tiny leak has turned into a significant issue.

Now, you might wonder, “Why should I consider early stage coverage? Isn’t it pricier?” Yes, early stage coverage tends to be a lot more expensive. But here’s the thing: with advancements in medical technology, early detections are becoming increasingly common. Catching an illness in its early stages means you can act on it sooner, potentially leading to better health outcomes.

We genuinely believe that the extra cost for early stage coverage is worth it. It’s not just about the financial aspect; it’s about giving yourself the best chance at a full recovery, should you ever face such a health challenge. Of course, there isn’t any hard and fast rule. You can have a combination of both if it makes the most financial sense for you.

3. Personal Accident Insurance

TDLR; Life’s unpredictable, and accidents can happen anytime, anywhere. Personal Accident Insurance is your financial armor against the unexpected bumps and bruises of life.

More details:

Even though we all wish for our days to unfold without a hitch, the reality is that accidents are unpredictable and can occur at any moment. Investing in a comprehensive personal accident insurance is an affordable means to safeguard against everything from minor mishaps like a bathroom slip to major incidents like car accidents that could lead to disability.

Why should you consider it?

-

Comprehensive Coverage: Unlike health insurance, which might cover your medical bills, Personal Accident Insurance can provide compensation for other impacts of an accident, like loss of income if you’re unable to work for a while.

-

No Medical Examinations: Getting this insurance is typically hassle-free. You usually don’t need to undergo any medical check-ups to get covered.

-

Affordable Premiums: Compared to other insurance types, Personal Accident Insurance often comes with affordable premiums, making it accessible for most.

While we can’t predict accidents, we can prepare for their financial impact. Personal Accident Insurance is about ensuring that when life takes an unexpected turn, you and your loved ones have the financial support to navigate through it.

4. Disability Income Insurance

TLDR; Life can sometimes throw challenges our way, and disability is one such challenge that can impact our ability to earn. Disability Income Insurance is your financial shield against such unforeseen circumstances.

More details:

Disability Income Insurance provides a monthly payout if you’re unable to work due to a disability. It’s like a financial safety net, ensuring you have a steady income even if health challenges prevent you from working.

Types of Disability Income Claims

-

Occupational Disability: This kicks in if you’re unable to perform the duties of your specific job due to a disability. Think of it as insurance recognizing that while you might not be able to do your current job, you could still perform other tasks.

-

Functional Disability: This is about the basics. If you’re unable to carry out the six activities of daily living (ADLs) - which include essential tasks like showering, dressing, and feeding yourself - then this claim comes into play.

Why is Disability Income Insurance Important?

While we all hope for good health, disabilities can happen unexpectedly. Disability can affect your ability to earn life-long. This insurance ensures that even if you face such challenges, your financial well-being isn’t compromised. It provides peace of mind, knowing you’ll have a steady income to support yourself and your loved ones.

A quick note on Careshield

CareShield is a long-term care insurance scheme in Singapore. It’s designed to provide lifetime coverage for severe disability, especially during old age. If you’re covered under CareShield, you’ll receive monthly payouts if you’re unable to perform at least three of the six ADLs.

Budget-Friendly Option with a Catch

Looking for a cost-effective way to get Disability Income Insurance? Consider adding it as a rider to your Personal Accident Insurance. However, there’s a catch: the disability must result from an accident for the coverage to apply. It’s a more budget-friendly option, but it’s essential to be aware of its limitations.

Some case studies

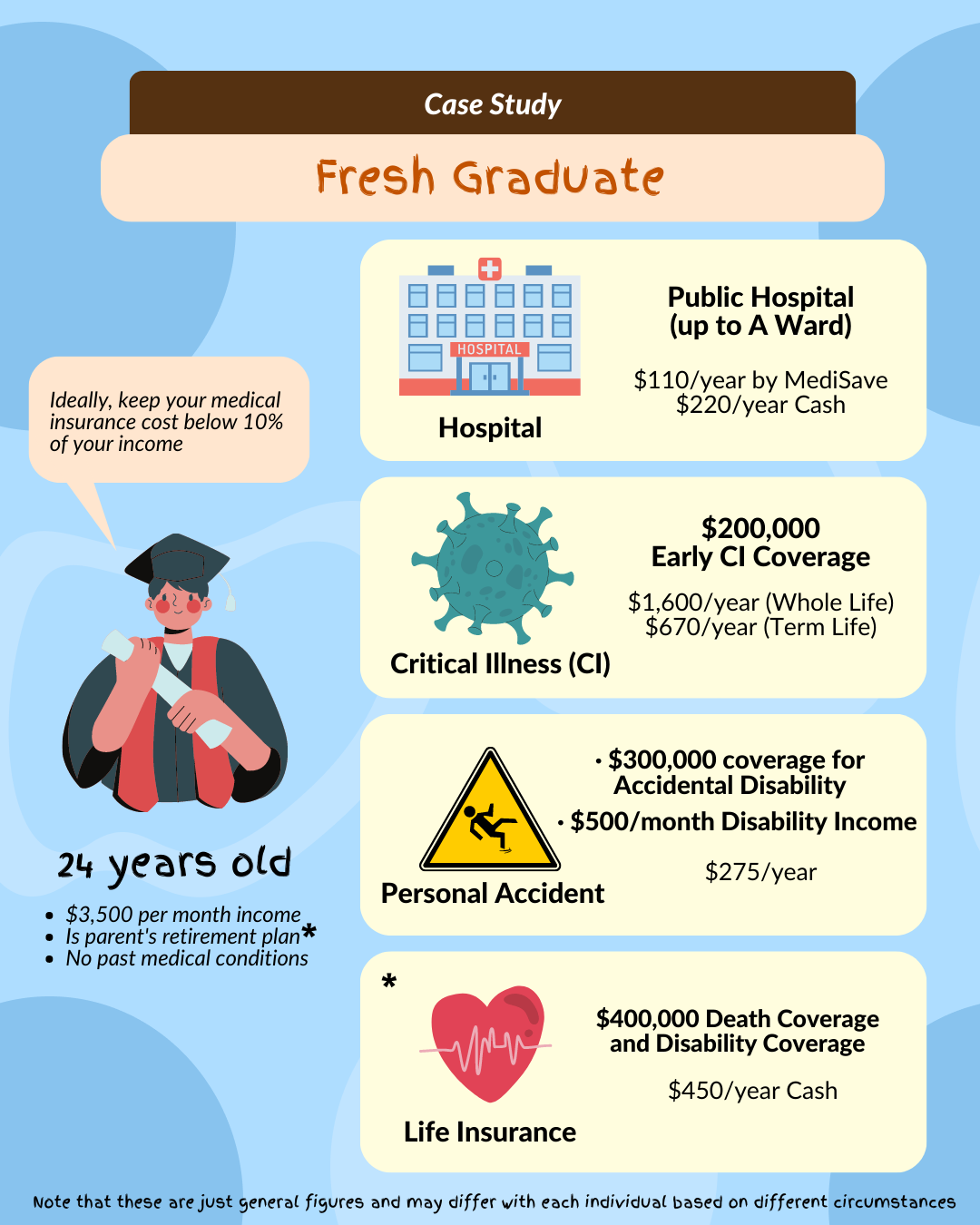

1. Fresh Graduate

As a fresh grad, you’ll prioritise getting the foundation of medical insurances- while balancing out the cost of it. Main component focuses on getting hospital coverage (hence limited to just up to A ward in public health coverage). Above that, setting the foundation of Life and Critical Illness coverage whilst a younger age of 24 years old. Additionally with parents reliant on him for retirement, death coverage was added.

and for those who are alittle more than a fresh grad…

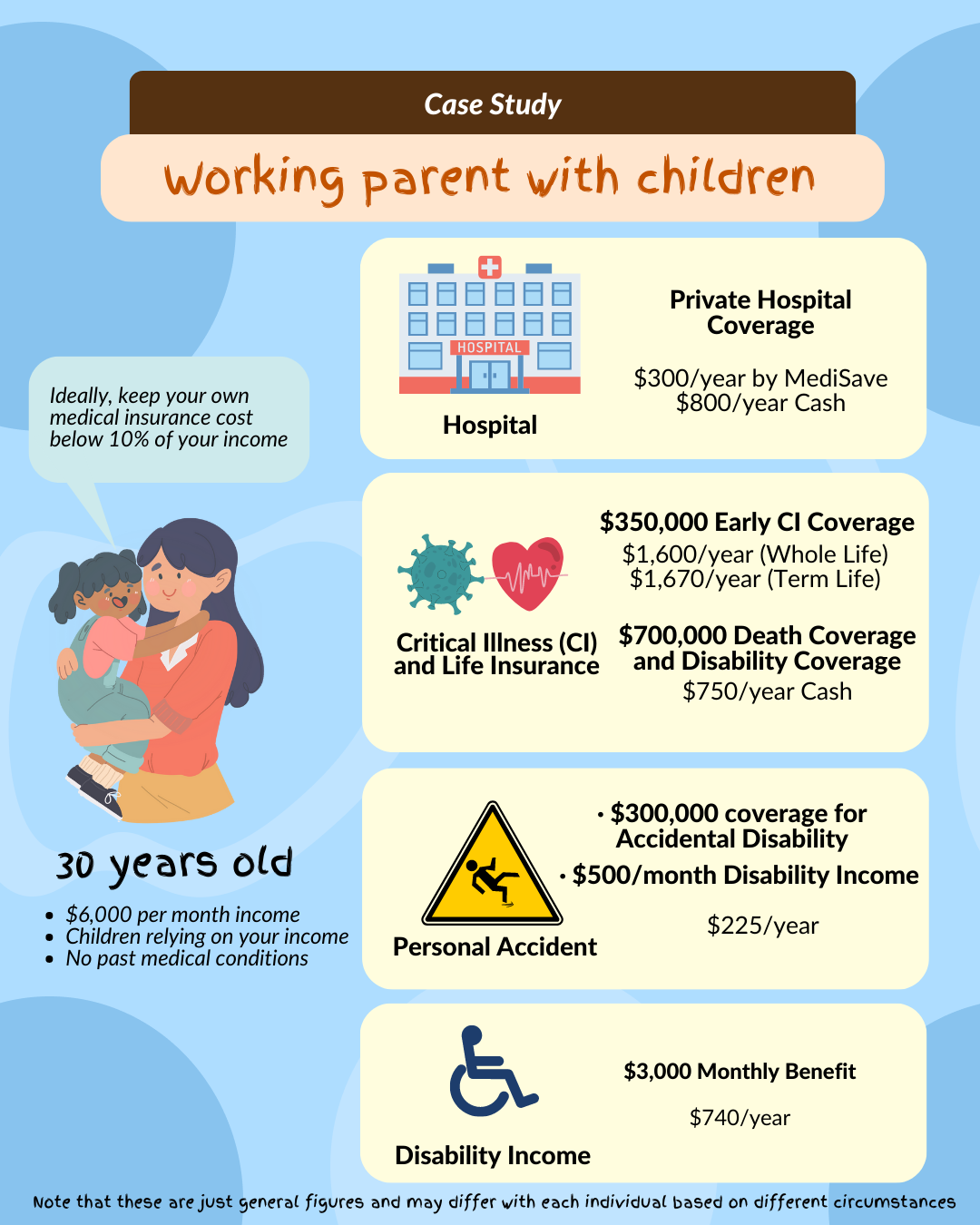

2. Young Parent

Main focus in this stage would be maintaining the current lifestyle (in the event of any medical situation) as much as possible now that there are dependants and that includes shared financial responsibilities with your partner! At this point, you would most likely be retaining the good basic coverages from your 20s and only adding on what’s necessary to boost your coverage with the new higher income dependency or to hedge against the higher risk.

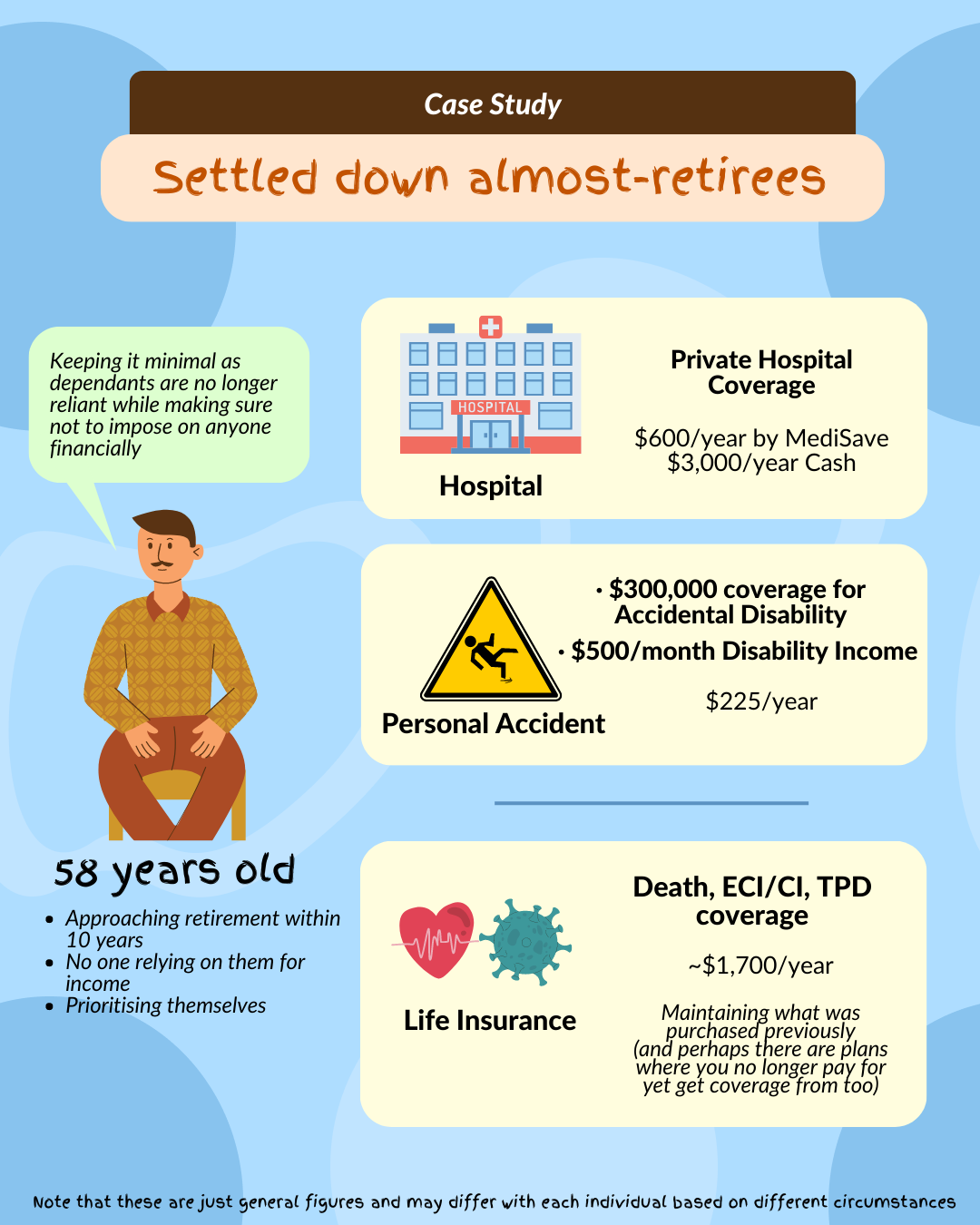

3. Settled down almost-retiree

With children that are independent and generally lesser dependence on your income, the focus would be on making sure big medical bills are covered for, if any, and to be able to retain a comfortable life moving forward. Often at this point you would also have medical plans such as Life plans that have been fully paid for (Premium term has ended) and you still get coverage for.

While hospital premiums would have increased substantially, it is the most important plan needed at this age and up to private healthcare in any case of urgent care needed and to be able to have the choice then.

Conclusion

Stepping into the real world is exhilarating, but it also comes with its fair share of responsibilities. And while insurance might not be the most thrilling topic on your list, it’s undeniably one of the most crucial. From safeguarding against hefty hospital bills to ensuring you have a financial cushion in the face of unexpected health challenges, the right insurance can make all the difference.

Remember, it’s not just about the here and now. It’s about planning for the future and ensuring that no matter what life throws your way, you’re prepared. So, as you embark on this exciting new chapter, take a moment to consider the safety nets you have in place. Because while life is unpredictable, with the right insurance, you can navigate its twists and turns with confidence.

Cheers to adulting the smart way!

Got questions?

If you need to speak to someone about your finances or need some help about navigating around your Insurances you may book a session with us where you may better understand your current policies or enquire further. We’re opening up a space just for you readers :)