How cheap is owning a car in Singapore?

The costs of renting a car, buying a new or second-hand car

Singapore is a fairly well-connected island with very accessible public transport. It is to the extent that having a car in Singapore often feels more like a want rather than a need.

There are definitely situations whereby it makes more sense to own a car. If you find yourself in such a situation or if owning a car is your dream, what is the cheapest way to get it?

In this article, we will look into the more affordable options of getting a car.

The cost price of a car

The price of the car itself is one of the biggest cash outlay that one has to fork out during this process. At this stage, one will have 3 options — a brand new car, a used car, or rent. To make the comparison more accurate, we will be looking into the price of the Mitsubishi Attrage. This car is listed amongst the top 5 cheapest cars that one can buy in Singapore by dollarsandsense.

Brand new car

Buying a car in Singapore can be a complicated process, it can be a standalone topic by itself. To read about it in-depth, you can refer to this article that we wrote earlier here.

Cost of buying a brand new car in 2022

All the underlying costs of a car purchase in Singaporemedium.com

The price of a brand new car depends heavily on when you buy it because the price of COE fluctuates based on demand. As of March 2022, the cost of the Mitsubishi Attrage in Singapore would cost you about $99,999

Second-Hand Car

When it comes to getting a second-hand car in Singapore, things get even more complicated. There are many factors to consider when getting a second-hand car, but for simplicity, we will only be looking at the cost of the car itself in this article. The cost of a second-hand car varies depending on multiple factors ranging from age, mileage, condition of the car, etc.

Using the data of the listing on Mitsubishi Attrage on sgcarmart, the cheapest one costs $34,800 and is about 6.5 years old. In other words has a remaining 3 yrs 6 months left before the COE expires. (Data accurate as of the time of writing)

When the COE expires, you would have the choice of either extending it or deregistering it. More often than not, most people would deregister it when it approaches the end of COE. When a car is deregistered within 10 years since registration, he/she will be receiving a small amount of money depending on the intended deregister date.

After some research done by us (we really mean googling), we found out that the best to sell a second-hand car would be around 3–4 years old. Cars tend to depreciate the most within the first few years of ownership. As a result of that, getting a second-hand car could mean significant cost savings.

So based on all these, we found the cost price of a Mitsubishi Attrage to be around $51,000 for a 3.5 year old car

Renting a car

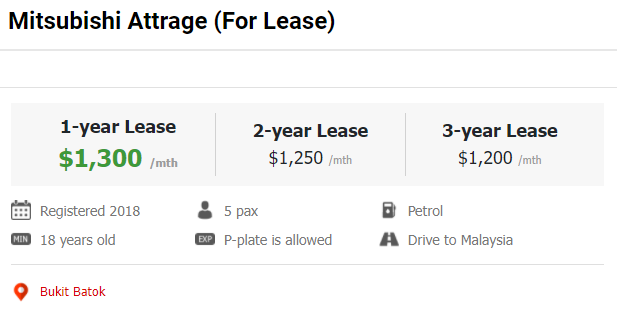

Renting a car in Singapore can be a good temporary solution if you only need it for a short period of time. The price of the rent depends on the duration of the rent. Refer to the image below for a snapshot of what it may look like.

source: sgcarmart

Comparing between the 3 options

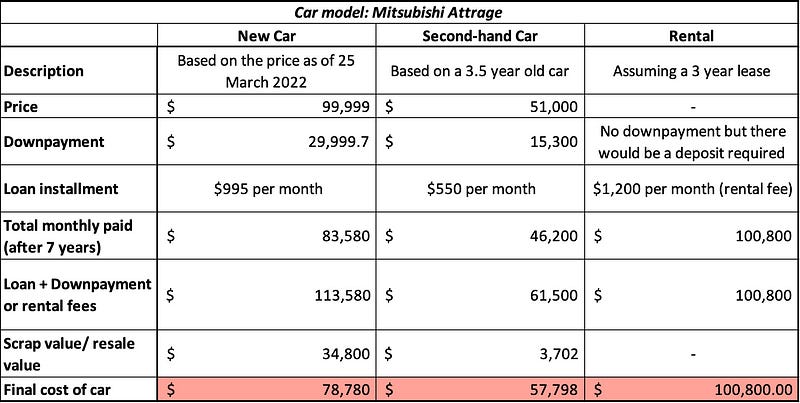

As a recap, here’s how much it will cost for the 3 different options:

If you wish to understand how the car loan is calculated, you can refer to this article here. The table above shows a possible outcome if you plan to get a car just for 7 years. Based on this, renting a car is definitely out of the picture. And getting a second-hand car is the cheapest alternative. However, it may be worthy to note that the maintenance cost of the second-hand car will be higher due to its old age.

On the other hand, if you take into account the opportunity cost of investing, buying a second-hand car would definitely make more sense if you were to invest the “savings” from getting a second-hand car as compared to buying a brand new one.

What if we shorten the duration of car ownership?

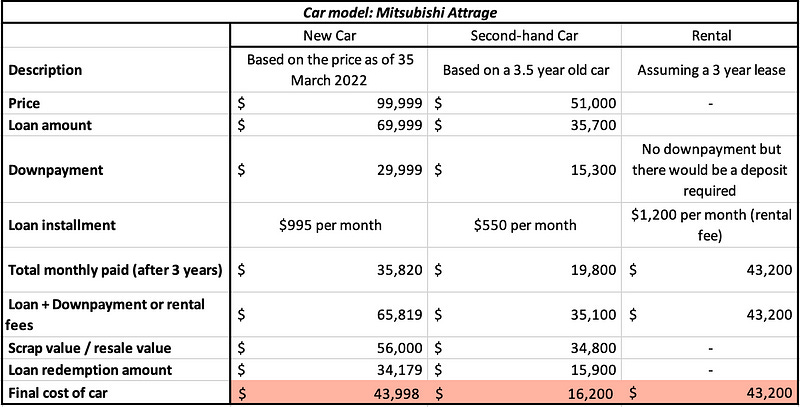

What if instead of using the car for 7 years, we only use it for 3 years and sell it right after?

The loan redemption amount is the sum one would have to pay the bank when he/she decide to fully pay back the loan. Before selling a car, they would have to settle the loan of the car first.

Buying and selling a second-hand car after 3 years seems like a good solution. By doing so, your upfront cost of the car is reduced significantly. However, though, there are a few caveats involved. For example, you’ll have to settle your car loans before selling them, the price of the car you sell depends on the car conditions and the market condition, etc.

Surprisingly though, if you are looking into owning a car just for a short period, there isn’t much difference between getting a new car and renting it. But of course, getting a second-hand car would be a more viable option.

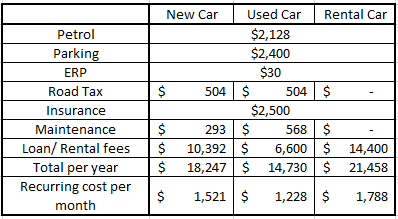

Recurring cost of car

Unfortunately, the price of the car is just the tip of the iceberg. Driving a car also means that you will incur a periodic cost from petrol, parking to road tax, etc. The table below sums up the recurring cost for the 3 options that we discussed in this article.

Looking purely at the monthly cost per month, the used car seems to be the most “centsible” choice.

Conclusion

Based on the information listed in this article, even the most affordable choice of owning a car would set you back by $1,228 per month. Unless you are ready and certain that you are able to afford that without affecting your short to long-term goal, do think twice before proceeding with your decision.