How to reduce your income tax

Tax relief strategies in Singapore 2022

It’s that time of the year again to do some last min tax relief. In fact, if you’re reading this today, 28 Dec, you are literally left with just 3 days to reduce your taxable income.

To help you get up to speed, we’ll be covering the basics of tax and tax relief strategies, and a couple of case studies for you to analyse and determine how you can plan out your tax relief strategy.

Understanding Taxes and what is chargeable income

First and foremost, it’s important to understand how you would be taxed in a year and what constitutes to be chargeable income. By definition, the chargeable income is your total taxable income less deductible expenses. In other words, all relevant income earned in the year would have to be taxed. Also, this would refer to income earned in Singapore.

Such income sources include salaries, securities’ interests, property income, and profits and gains earned from businesses, professions, or vocations.

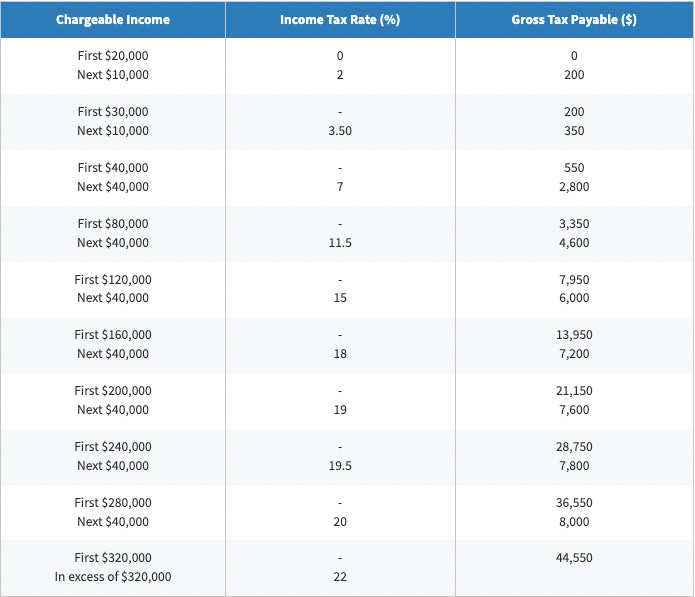

Fun fact: Singapore follows a progressive resident tax rate from 0 and ending at 22%, above S$320,000. So the more income earned naturally a higher percentage of income is taxed — which raises the further need for tax relief.

Here are the relevant tax rates for the year 2022:

Resident Tax Rates

Source: IRAS

How does tax relief work?

By contributing to the various relevant methods, you are able to reduce your chargeable assessable income. Therefore, paying less income tax.

Do note that Personal income tax reliefs are subject to a cap of S$80,000 per year of assessment (YA). Some tax reliefs are automatically calculated, like child reliefs and earned income reliefs while some need to be ‘declared’ in order to enjoy the tax relief.

Source: iras.gov.sg/taxes/individual-income-tax/employees/basic-guide-for-new-individual-taxpayers

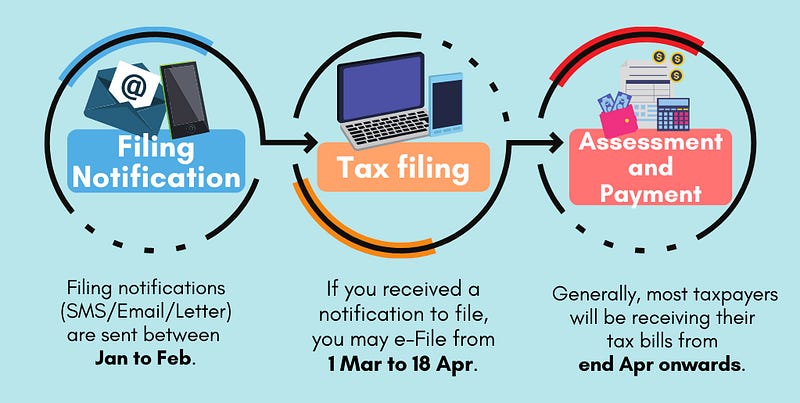

Timeline of tax relief

Tax relief efforts are reviewed annually. Income is assessed on a preceding calendar year basis, ending 31 December. In order to be eligible for a lower tax payable next year, you will have to do it the previous year. If the tax return is not filed by the deadline, IRAS may raise the estimated assessment. You can usually expect to receive the income tax bills from May to August.

Types of tax relief

It is important to plan out your tax reliefs carefully. Just because you are potentially able to reach the full tax relief cap of S$80,000, does not mean that you should.

By planning the tax relief thoroughly, you can potentially even bring yourself down to a lower tax bracket and consequently, be charged a lower income tax rate.

**The tax relief you are automatically eligible for

**As a general overview, here are some of the reliefs that you may automatically be eligible for.

It is still important to check which tax you are eligible for. This helps you to facilitate your tax relief strategy and to make sure nothing is being left out

The tax relief you need to apply for

Here are some additional reliefs that need to be applied (if you are eligible).

Some of the reliefs that will require application include the CPF Relief, and SRS Relief. In the following sections, we will elaborate more on the ones that require your manual application.

Tax Relief Strategy

Cash top-up to CPF Accounts

One common way tax relief is done is through the cash top-ups to our CPF accounts. After all, it is given to encourage us to save for our/our loved ones’ retirement. It is applicable to Singapore Citizens or Singapore Permanent Residents.

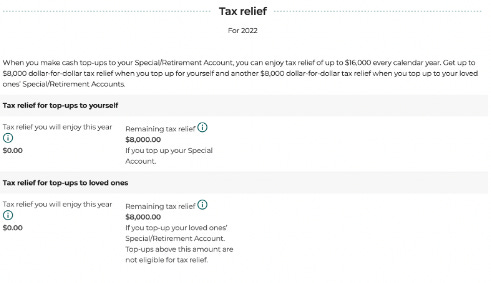

The tax relief cap will be shared for cash top-ups to Special Account (SA)/Retirement Account (RA) and/or cash top-ups to MediSave Account (MA) of $8,000. Above that, an additional tax relief of up to $8,000 when you top up your loved ones’ Special/Retirement Account and/or MediSave Account.

**CPF Retirement Sum Topping-up Scheme

**Under this scheme, you are able to do cash top-ups to the Special Account and Retirement Account. This applies to not only your own accounts but your loved ones too (Siblings, spouse, parents, grandparents and more).

-

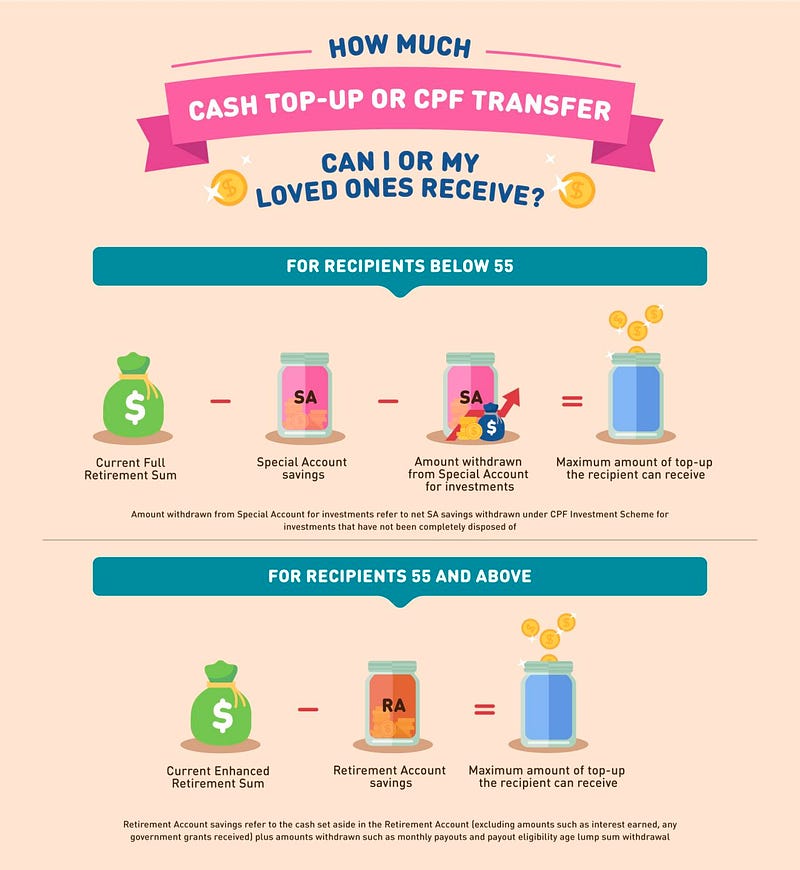

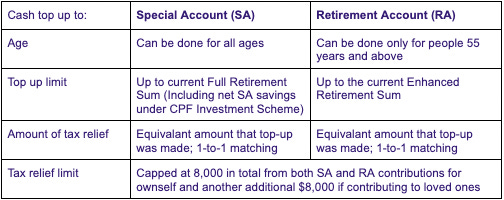

**Special Account (SA) top-up

**Especially if you are under the age of 55 years old, this is one you may utilise since your retirement account have yet to exist. You can top up your own Special Account (SA) up to the current Full Retirement Sum of the year for a 1-to-1 match of relief capped at $8,000 per calendar year. As of 2022, the FRS amount is $192,000.

In addition, you can top up to your loved one’s SA too to be eligible for an additional $8,000 tax relief cap. Alternatively a top-up to their Retirement Account (RA) which we would explain below.

**Why is it great?

**The CPF Special account gives a 4% compounding interest rate and will eventually grow your retirement savings! -

**Retirement Account (RA) Top-up

**If you are above the age of 55 years old and above or topping up for someone who is, this is an additional account you may top up to. You are able to top up to the current Enhanced Retirement Sum (ERS).

source: Source: CPF website

Why is it great?

Similar to the Special Account, the retirement account gives a 4% compounding interest rate and will eventually grow your retirement savings! Especially for those that already have their BRS (+ own a home) or FRS settled for its accessible cash monies and hence makes for a higher incentive over the tax relief!

Comparison of cash top-up done to SA and RA

Tip: You can log in with your Singpass to find out how much cash top-ups and CPF transfers you can make to yourself and your loved ones. Below is a screenshot of what it looks like:

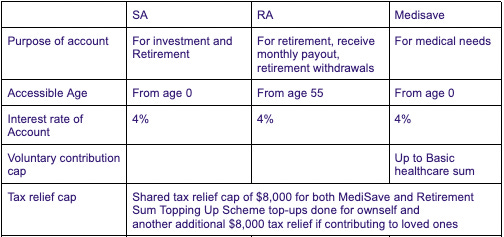

3. Medisave top-ups: Voluntary Contributions to MediSave Account (VC-MA)

An alternative to cash top ups of your SA and RA is the Medisave account. In fact, especially if you are still young (ie under 55 years old), these monies are alot more accessible! That’s because your Medisave is the account dedicated for medical bill payments such as hospital treatments and insurance premiums.

The Voluntary Contributions to MediSave Account (VC-MA) can be made up to the Basic Healthcare Sum ($66,000 in 2022, $68,500 in 2023).

Why topping up MA may be better than SA?

An important thing to note is that whatever balance that is above the Basic Healthcare Sum (BHS) would flow out to the CPF Special account. This includes the interest and extra interest that’s given to you on your Medisave balance. Just imagine the compounding effect it will have on your special account! If the BHS is within your reach, it is definitely worthwhile to consider.

Comparison between topping up SA, RA and MA

Supplementary Retirement Scheme (SRS) tax relief

The Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings. It acts simply as an account that funds you can only access fully(and without paying tax) in retirement age, the statuary age where you open the account is crucial as well. Also, because of its nature of simply being an account, you would need to invest the SRS funds for the growth of value, or it’ll stay idle and erode to inflation.

The SRS Relief is a voluntary scheme to encourage individuals to save for retirement, on top of their CPF savings. Contributions to your SRS account are eligible for tax relief — in fact, it makes for a really good one as it is a dollar-for-dollar tax deduction on top-ups of up to $15,300 (and $35,700 for foreigners) a year. This is also the maximum we can top-up our SRS account each year as well.

It is also automatically claimed and you need not make a manual SRS tax relief.

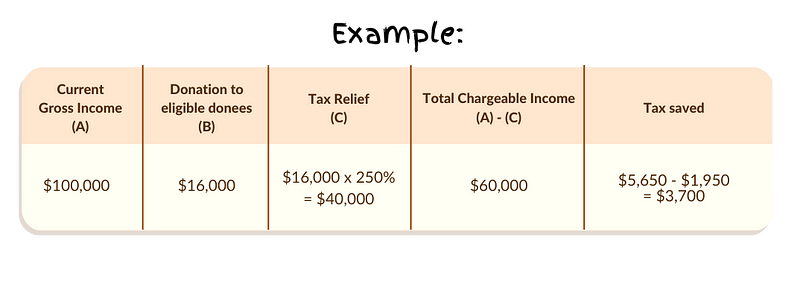

Donation

Other than topping up your CPF, you can also donate to your favourite cause and earn some tax relief along the way! In fact, eligible donation grants you a 250% tax reduction (the capped of $80,000 still applies though)

If you have a cause that you passionately want to support, good news! you can get a 250% tax reduction.

Case Study

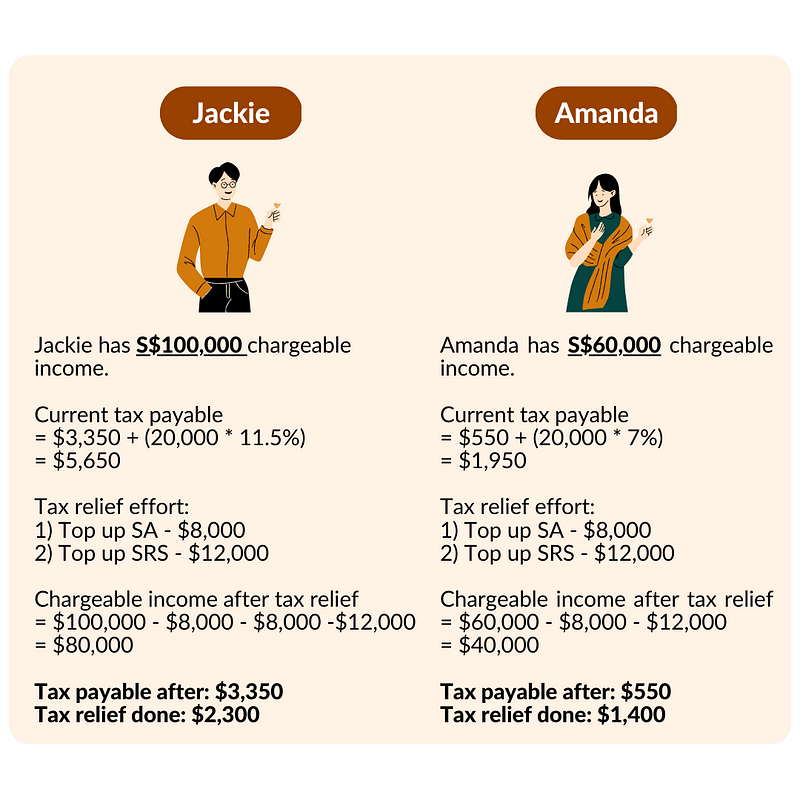

Although Jackie and Amanda contributed the same amount to their SA & SRS for tax relief, Jackie saved 60% more than Amanda.

This is mainly due to the higher income tax rate for higher-income earners. So if you belong to the higher income bracket, you can definitely save more with these schemes.

Conclusion

For your planning and consideration, consider these to plan out your best tax relief strategy:

-

Efforts spent on tax relief, differing from an income bracket

-

Is it worth locking a larger sum of money till late age just to save a thousand?

Ultimately, we think that tax relief shouldn’t be your only reason to contribute to these schemes. Ensure that your planning is properly considered, such as your retirement goals, and cash flow and most importantly, that all is within your means.