SGX-Nasdaq Bridge: What This Historic Partnership Means for Singapore Investors

Discover how the new SGX-Nasdaq dual listing bridge transforms opportunities for Singapore investors with easier global access and enhanced liquidity.

Big news just dropped in Singapore’s financial world, and if you’re an investor here, you need to pay attention. On November 19, 2025, the Singapore Exchange (SGX) and Nasdaq announced a landmark partnership that could fundamentally change how Singaporeans invest and how Asian companies access capital.

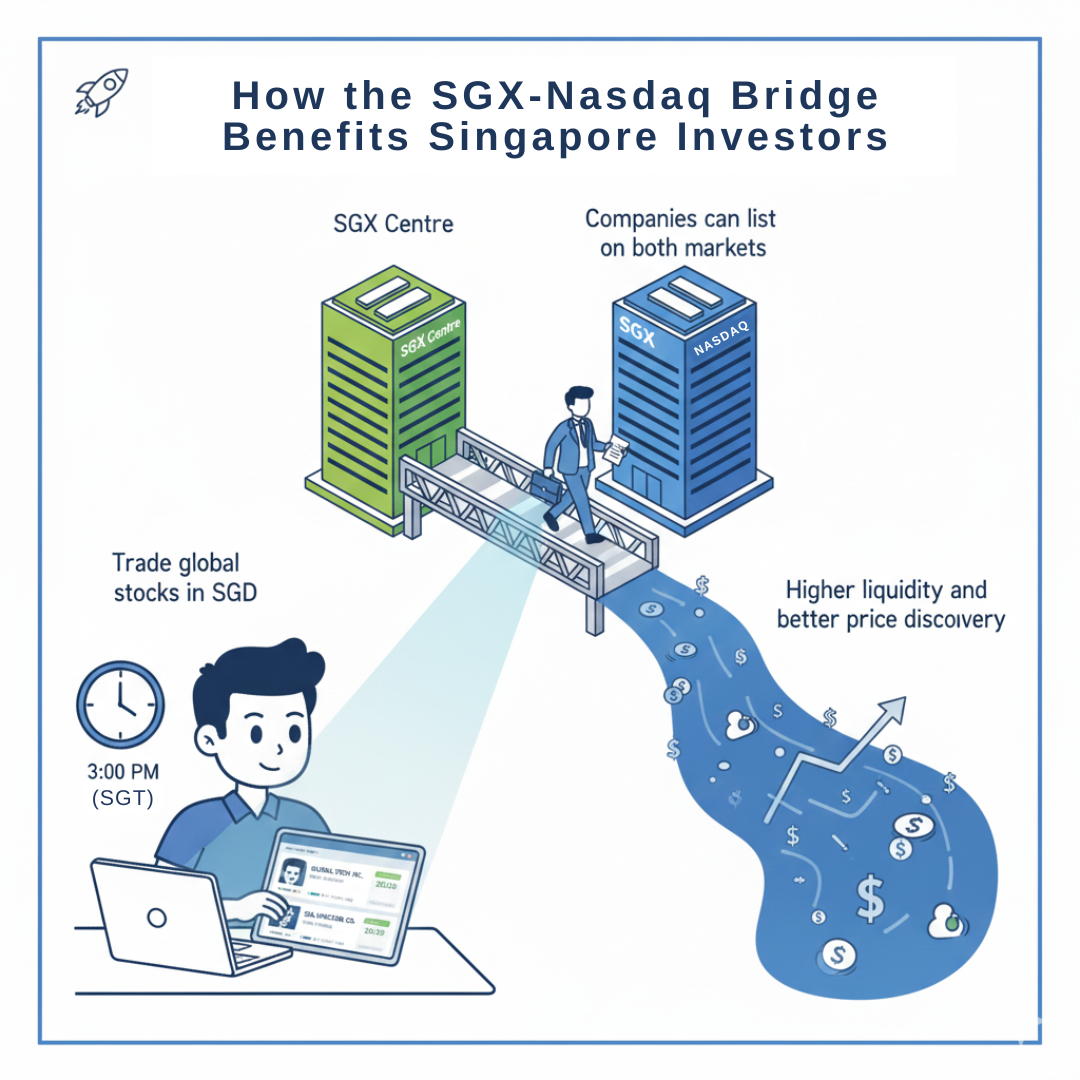

This isn’t just another corporate handshake. It’s the first collaboration of its kind between these two major exchanges, creating what’s being called a “dual listing bridge” that allows companies to list on both SGX and Nasdaq simultaneously using just one set of documents. Think of it as building a superhighway between Singapore and Wall Street, and Singapore investors are about to get front-row seats to the action.

What Exactly Is This SGX-Nasdaq Dual Listing Bridge?

The dual listing bridge is a framework that allows companies with a market capitalization of S$2 billion and above to list on both SGX and Nasdaq concurrently through a streamlined process. Instead of going through the traditional dual listing route—which requires separate documentation, duplicate regulatory reviews, and significantly higher costs—companies can now use a single set of offering documents and a simplified review process.

The bridge is expected to go live around mid-2026, subject to regulatory approvals. SGX will launch a new “Global Listing Board” specifically for this purpose, complementing the existing mainboard and Catalist. Companies listing on this board can choose to denominate their shares in either US dollars or Singapore dollars, and trading will take place on both exchanges.

Here’s where it gets interesting for Singapore investors: when US markets are open (10:30 PM to 5:00 AM Singapore time during daylight saving), you’ll be able to track and potentially trade these dual-listed stocks, essentially giving you round-the-clock market access.

Why This Is a Game-Changer for Singapore Investors

1. Access to Global Growth Companies Without the Hassle

Traditionally, if you wanted to invest in high-growth tech companies or other innovative businesses, you had two options: use a foreign brokerage account to buy US-listed stocks (dealing with currency conversion, unfamiliar platforms, and potentially higher fees), or miss out entirely.

The dual listing bridge changes this equation. Companies that dual-list will be available right here on SGX, using your existing Singapore brokerage account. You can trade these stocks in Singapore dollars during Singapore hours, avoiding the midnight oil-burning sessions needed to trade during US market hours.

2. More Quality Companies Staying (or Returning) Home

Let’s address the elephant in the room: some of Singapore’s most successful companies such as Grab, Sea (formerly Garena), and others—chose to list in the United States rather than on SGX. Why? Access to deeper capital pools, higher valuations, and a broader investor base. The Singaporean Investors has a good article explaining this, read it here.

The dual listing bridge could change this. Instead of forcing companies to choose between SGX and Nasdaq, they can now have both. This means companies can tap into US capital markets while maintaining strong connections to their Asian operational base and investor community.

3. Enhanced Liquidity and Better Price Discovery

One of Singapore’s stock market’s persistent challenges has been liquidity, especially for small and mid-cap stocks. The dual listing bridge addresses this by connecting SGX to Nasdaq’s deep liquidity pools .

For investors, better liquidity means tighter bid-ask spreads, easier entry and exit from positions, and more efficient price discovery. When a stock trades on both exchanges, price signals from overnight US trading flow directly into SGX’s morning session, creating more responsive and dynamic markets

The Straits Times Index (STI) has already been performing well, hitting an all-time high of $4,575.91 in November 2025 and delivering a 25.8% total return year-to-date as of November 14. The dual listing bridge could help sustain this momentum by attracting more quality listings and institutional investor interest

The Bigger Picture: Singapore’s Market Revival Strategy

The SGX-Nasdaq bridge doesn’t exist in isolation. It’s part of a comprehensive strategy by the Monetary Authority of Singapore (MAS) to revitalize Singapore’s equities market. Let me walk you through the other major initiatives that directly benefit you as an investor:

1. The S$5 Billion Equity Market Development Programme (EQDP)

MAS has allocated S$5 billion to fund managers to invest specifically in Singapore-listed stocks, with a focus on small and mid-cap companies. So far, S$3.95 billion has been deployed to nine fund managers, including JP Morgan Asset Management, Fullerton Fund Management, and Avanda Investment Management. Read more about the EQDP here.

For investors, this means:

- Increased liquidity in smaller stocks that were previously overlooked

- Better research coverage as fund managers dig deeper into these companies

- Potential for market-beating returns as undervalued stocks get discovered

The impact is already visible. Average daily turnover in Q3 2025 rose 16% year-on-year to S$1.53 billion, the highest since Q1 2021. Retail investors’ net purchases surged to a 10-month high of S$685 million in August 2025.

2. Board Lot Size Reduction: Making Blue Chips Affordable

SGX plans to reduce the board lot size for securities priced above S$10 from 100 units to 10 units. This consultation will happen in Q1 2026.

What does this mean? Let’s use DBS as an example. At around S$53.70 per share, you currently need S$5,370 (100 shares x S$53.70) to buy a board lot. After the change, you’ll only need S$537 (10 shares x S$53.70).

This is huge for:

- Young investors just starting their portfolios

- Dollar-cost averaging strategies where you invest smaller amounts regularly

- Portfolio diversification as you can spread the same capital across more stocks

What Types of Companies Will Benefit Most?

Not every company will use the dual listing bridge, and that’s by design. The S$2 billion market cap requirement ensures that only established, well-governed companies qualify. But within this group, certain sectors stand out as prime candidates:

Southeast Asian Tech Unicorns and Growth Companies Southeast Asia has seen explosive growth in unicorns (startups valued over US$1 billion), growing from just five in 2016 to over 60 in 2025. Many of these companies in fintech, e-commerce, mobility, and digital services have strong Asian operations but want access to US tech valuations.

Companies in sectors like:

- Digital payments and fintech (think companies similar to Grab’s financial services)

- E-commerce and online travel platforms with regional dominance

- Enterprise SaaS and B2B technology (like AvePoint, which pioneered this path)

Non-Chinese Asian Growth Companies While Hong Kong has long been the preferred listing destination for Chinese companies seeking international capital, many non-Chinese Asian enterprises are now looking elsewhere. For them, the SGX–Nasdaq bridge offers a distinct edge: streamlined access to both U.S. and Asian capital markets, without the overhang of geopolitical complications.

This positions Singapore as a neutral alternative with strong regulatory alignment to global standards, particularly attractive in an era of US-China tensions

Real Benefits for Your Investment Strategy

So what does this mean for your portfolio?

For Retail Investors: Diversification Without Complexity If you’re a retail investor with a Singapore brokerage account, the dual listing bridge gives you:

- Geographical diversification across Asian and US markets without needing multiple brokerage accounts

- Currency options to manage foreign exchange exposure by trading SGD-denominated counters

- Extended market hours to respond to overnight developments in US markets

- Higher transparency standards as companies meet both Nasdaq and SGX disclosure requirements

If you invest using your CPF funds, this might mean more opportunities to invest in Singapore-listed stocks that are dual-listed on Nasdaq.

For Growth-Focused Investors: Access to High-Growth Sectors Singapore’s traditional stock market has been dominated by banks and REITs. While these provide stability and dividends, growth investors have often looked overseas for exposure to technology, innovation, and emerging sectors.

The dual listing bridge changes this by potentially bringing tech platforms, digital services, biotech, and other high-growth companies to SGX. This allows growth-focused investors to build more diversified portfolios without going offshore

Potential Challenges and Considerations

The SGX-Nasdaq dual listing bridge offers exciting opportunities, but it also comes with trade-offs.

-

Companies will still have to follow rules from both Singapore and the U.S., and there are open questions about how settlement and investor protection will work in practice.

-

The exchanges plan to use strong surveillance systems to prevent market abuse, but many details are still being worked out.

-

Differences in valuation between the U.S. and Singapore, plus lower trading activity on SGX, could also mean some companies continue to prefer listing only on Nasdaq.

-

On top of that, the mid-2026 launch target may be pushed back due to the complexity of aligning both markets’ regulations, and global factors—such as modest growth, shifting policies, and geopolitical tensions—could affect how quickly the bridge is adopted.

Some food for thought on your Portfolio

1. Stay Informed About New Listings

Keep an eye on announcements from SGX about companies considering dual listings. Early movers often generate significant interest and trading volume.

2. Review Your Broker Capabilities

If you’re still using a traditional CDP-linked account, consider exploring brokers that offer:

- Custodian accounts with fractional trading

- CPF/SRS account linkage

- Extended US trading hours

- Lower custody fees or fee waivers

Tiger Brokers, Moomoo, and Syfe are popular options, but do your own research to find the best fit for your needs.

3. Consider Small and Mid-Cap Exposure

With the EQDP pumping liquidity into small and mid-cap stocks, there may be opportunities in overlooked companies getting rediscovered. The iEdge Singapore Next 50 Index, launched in September 2025, tracks the next tier of 50 companies beyond the STI’s 30 largest stocks.

4. Watch for Secondary Listings

Companies already listed on Nasdaq might pursue secondary SGX listings to access Asian liquidity. If companies like Grab or Sea announce plans to dual-list, it could be a significant market event worth monitoring

The Long-Term Vision: Singapore as a Global Financial Hub

Stepping back, the SGX-Nasdaq bridge represents more than just a new listing option. It’s part of Singapore’s strategic positioning as a bridge between East and West, a neutral financial hub in an increasingly fragmented world.

For Singapore, this means:

- Strengthening its role as Asia’s premier financial center

- Attracting more regional headquarters of tech and growth companies

- Building a more vibrant startup-to-IPO ecosystem where companies can grow from seed stage to public markets without leaving the region

- Creating opportunities for Singapore’s financial services sector (investment banking, research, fund management) to grow

What’s Next?

Here’s what to watch for in the coming months:

Q1 2026:

- SGX consultation on board lot size reduction

- Details on market maker incentives for small and mid-cap stocks

- Announcement of additional EQDP fund managers (third batch)

Mid-2026:

- Launch of the Global Listing Board and dual listing bridge

- First companies potentially dual-listing under the new framework

Beyond 2026:

- Potential secondary listings from existing US-listed Singapore companies

- Possible expansion of EQDP funding if initial results are positive

The Bottom Line

The SGX-Nasdaq dual listing bridge is a watershed moment for Singapore’s financial markets and investors. But like any investment opportunity, it requires informed decision-making. The bridge solves many problems—regulatory friction, duplicate costs, forced choices between markets—but doesn’t eliminate fundamental investment risks or market uncertainties. For Singapore investors, the message is clear: your home market is becoming more connected, more liquid, and more attractive to global companies.