Should You Terminate Your ILP? Here's Our 2 Cents On Making The Right Call

Confused about whether to keep or terminate your Investment-Linked Policy? We break down the two types of ILPs and give you a framework to make an informed decision without the jargon.

So, you’ve got an Investment-Linked Policy (ILP) sitting in your drawer, and lately, you’ve been hearing whispers on Reddit, TikTok, and your WhatsApp/Telegram finance group chat that it might be a terrible idea to keep it. Maybe your agent sold it to you years ago when you were fresh out of university and didn’t know any better. Or perhaps you picked one thinking it’d be a two-in-one solution for both your insurance and investment needs. Now you’re wondering: Should I just terminate my ILP?

Here’s the honest answer: it depends. And that’s not us dodging the question, it’s genuinely more nuanced than “ILPs are bad, get out now.” Let us give you our “2 cents” on how to think about this properly.

Understanding Your ILP: The Two Very Different Types

Before you make any decision, you need to know which type of ILP (out of the two types) you actually have. This is crucial because they work very differently, and the decision to terminate (or not) depends heavily on this.

Type 1: Investment-Focused ILP

This is the newer breed of ILP that’s really designed with investment as the priority. Think of it as a fancy investment account that has a minimal insurance wrapper around it—often just returning 101% of your premiums if something happens to you.

What this means for you:

- You’re mostly paying to invest in funds of your choice (or your agent’s recommendation)

- The insurance component is really just a safety net, not the main feature

- Your cash value depends almost entirely on how well the underlying funds perform

Type 2: Insurance-Focused ILP with Investment

This is the older, more complex cousin. It’s designed primarily to give you solid insurance coverage (death, critical illness, TPD, etc.) while embedding some investment growth into the mix.

What this means for you:

- You’re paying for real insurance protection that increases with age

- As you get older, more of your investment value gets eaten up by rising insurance costs/ mortality charges

- If the investments don’t perform well, you might end up with insufficient funds to pay for the insurance, potentially causing your policy to lapse

The distinction matters because your next steps are completely different depending on which one you have. Check your policy document or call your agent to confirm.

If You Have an Investment-Focused ILP

Let’s say you’ve got the modern investment-focused type. Here’s the framework we’d use to decide whether to terminate:

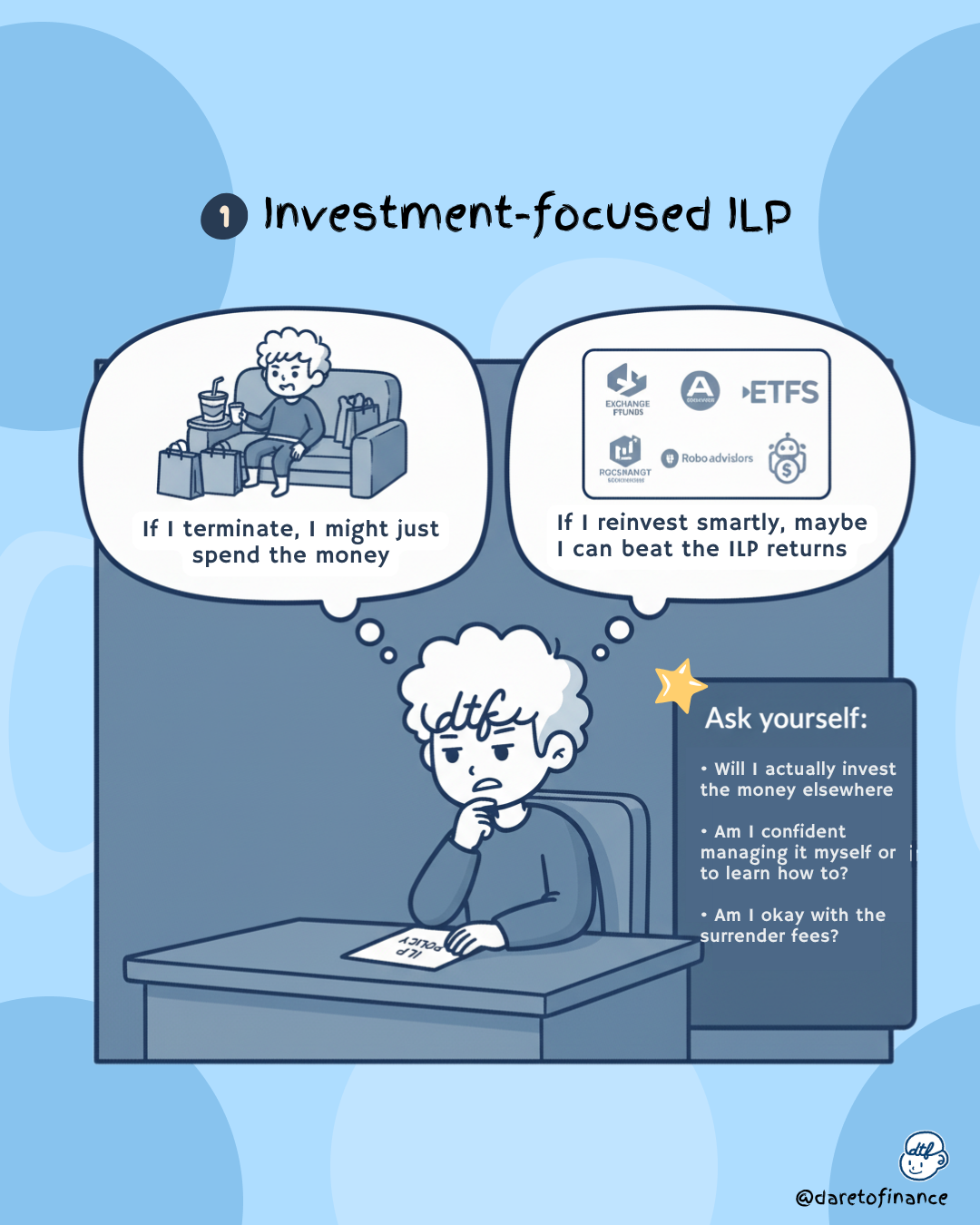

Step 1: Understand Your Real Alternative

This is the most important step — and one that people often skip.

Don’t just ask “Is my ILP good?” Instead, ask “What would I actually do with that money if I terminate?”

If your alternative is:

-

Not investing at all →

Your ILP might actually be worth keeping. At least your money’s working for you instead of sitting idle.

Yes, the fees are higher than ideal, but something beats nothing — especially if the ILP is the only thing keeping you invested. -

Investing in low-cost ETFs or global index funds →

This is where things get interesting. An ILP typically charges around 2-3% annually in total fees (insurance, fund management, admin), whereas ETFs or index funds often cost 0.2-0.3% a year.

That’s a massive difference compounding over decades.

Terminating could make sense if you meet a few conditions:- You’re confident investing directly in the market — or willing to learn.

- You can stay consistent even when markets get volatile.

- You’re comfortable with any potential surrender loss from termination.

If that sounds like you, moving to a lower-cost structure could pay off significantly in the long run.

-

Using a robo-advisor →

Robo-advisors charge 0.5-0.8% annually, still much cheaper than ILPs and fully managed for you.

They can be a good middle ground — giving you low-cost diversification without needing to pick and rebalance your own funds.

The key question: Can you honestly say you’d invest the money elsewhere if you terminate? Because if you can’t, staying in the ILP is better than letting your cash sit idle.

Step 2: Check Your Current Performance

Now look at how your ILP has actually performed. This isn’t about projections in your benefit illustrations—it’s about real numbers.

How to do this:

- Log into your policy portal (PRUaccess for Prudential, or your insurer’s equivalent)

- Check the actual returns of your underlying funds year-to-date and over the past 5 years

- Subtract all fees (fund fees, insurance charges, admin fees) to get your net return

- Compare this to how VWRA, a low-cost index, or a robo-advisor would have done in the same period

Be honest with yourself here. If your ILP is returning 2-3% after fees while VWRA or a global index returned 7-8%, the opportunity cost is real and compounding.

💡 Note: Sometimes the issue isn’t your ILP itself—it’s the underlying funds. If your funds are consistently underperforming, explore switching to better options within your ILP before deciding to terminate.

Step 3: Evaluate Your Actual Expectations

A lot of people stay in ILPs because they bought them on the promise of “10% returns” that never materialized. Others terminate because they think the market will bounce back and they don’t want to miss gains.

Real talk: No one can predict market returns. But you can ask yourself:

- Why did you buy this ILP in the first place? Has that reason changed?

- What returns do you realistically expect from your chosen funds?

- Are those returns worth paying the higher fees to keep the ILP?

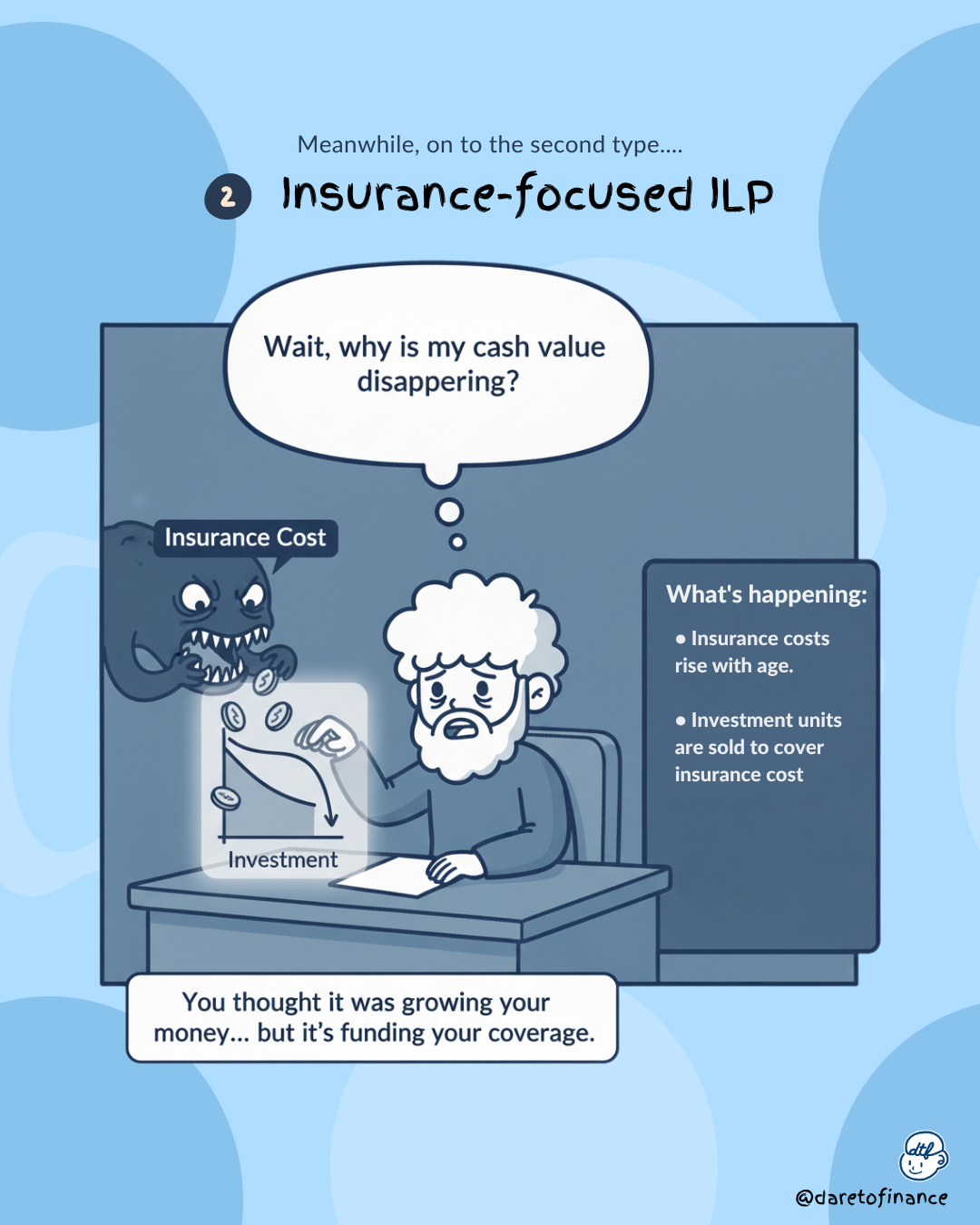

If You Have an Insurance-Focused ILP

This is where the decision gets genuinely complex because you’re weighing two things: insurance coverage and investment growth—and they’re pulling in opposite directions.

The Insurance Dilemma: Your Escalating Costs

Here’s what many people don’t realize: as you age, the insurance component of your ILP gets more expensive. Your mortality charges (the cost to insure you) increase every year because, statistically, the risk of death and critical illness rises with age.

This means:

- More of your investment units get automatically sold each year to pay for insurance

- Your cash value grows more slowly or might even shrink in later years

- You might wake up at age 55 with barely any units left to cash out because they’ve all been sold to pay for insurance.

This is especially problematic if you’re relying on the ILP to fund your retirement. You thought you were investing, but you’re actually subsidizing insurance costs that increase over time.

The Key Questions

Before you terminate an insurance-focused ILP, ask yourself:

1. Is your insurance coverage adequate if you terminate?

If this is your only insurance policy, terminating without a replacement is genuinely risky. The problem is that if you have pre-existing health conditions, getting new insurance might be impossible or prohibitively expensive.

If you’ve developed health issues and your doctor says new insurance is off the table (or costs an arm and a leg), keeping your ILP for the insurance component might be your only practical option. While ILPs go through the same health declarations and underwriting as other plans, insurers are often more tolerant of health risks within them — a small but real advantage.

However, compare the cost of getting a separate term insurance plan + investing the difference elsewhere. You might find that term life insurance (which costs $18-40/month for decent coverage for a 30-year-old) plus investing in a robo-advisor is way cheaper than keeping your ILP.

2. What’s your actual surrender value right now?

Get your surrender table from your insurer. This shows what you’d get if you terminate at different points in time.

Heads up: If you’re in years 1-3 of an ILP, surrender charges can be 100%, 80%, or more. You could literally get back less than you’ve paid in premiums. So timing matters enormously.

3. Can you stomach watching your coverage erode with age?

Even if your ILP is “performing okay,” rising insurance costs + market volatility mean there’s a real risk your policy collapses in later years. Are you comfortable with that? Or would you prefer the certainty of term insurance + separate investments?

The Surrender Charges Reality Check

Here’s where many people get stuck: the surrender charges on ILPs.

Typical surrender schedule:

- Year 1: Up to 100% charge (you might get nothing back)

- Year 2-3: 80% charge

- Year 4-10: Charges decrease by ~10% annually

- Year 11+: Surrender charge drops to 0%

This is why you hear people say “I’m just going to hold until year 11 to avoid the penalties.” And sometimes that’s the right call. Sometimes it’s a sunk cost fallacy.

The truth: Those upfront charges represent your agent’s commission. Whether you terminate now or in 10 years, that money is already gone — your agent got paid. Holding on to avoid penalties just means you’re continuing to pay high fees on an underperforming product.

So when does waiting make sense? Only if:

- Your surrender charges are dropping year by year

- Your underlying investments are performing decently

- You’re genuinely willing to hold until charges hit zero

- You don’t have a better alternative for that capital

Otherwise, paying the penalty to escape might actually be the financially better move. Run the math.

When to Keep Your ILP (Yes, There Are Valid Reasons)

We’re not saying “terminate your ILP immediately.” There are legit scenarios where keeping it makes sense. In fact, there are situation where we would recommend getting an ILP.

Investment-focused ILP

1. You’re Already 8+ Years In

If you’re past the bulk of the surrender charges and your funds are performing reasonably well, the math changes. The remaining drag from fees might be smaller than the cost to terminate and rebuild.

2. Your cash would be idle if you terminate

If you don’t have a better alternative for that capital, keeping your ILP is a good option.

3. Your ILP funds are performing well

If your ILP funds are performing well, why rock the boat?

4. You don’t want to handle your own investment

If you lack the time, knowledge, or discipline to manage your own investment, an ILP is a good option. Sometimes, the fees are worth it to have someone else do the heavy lifting for you.

Others

Of course there may be other reasons why you would want to keep your ILP, but these are the most common ones. Please speak to your financial advisor to help you make the best decision for your situation.

Insurance-focused ILP

1. You’re okay with the increasing insurance charges

You’re okay with the increasing insurance charges as you age. Perhaps you plan to cash out your ILP when you are older before the insurance charges get too high.

2. You can’t get new health insurance

If you’ve developed health issues and unable to get new insurance (or costs an arm and a leg), keeping your ILP for the insurance component might be your only practical option. While ILPs go through the same health declarations and underwriting as other plans, insurers are often more tolerant of health risks within them — a small but real advantage.

3. You plan to cancel the plan when you are older

If you don’t plan to have any insurance coverage when you’re older. when the insurance charges gets too high. image.png

Others

Of course there may be other reasons why you would want to keep your ILP, but these are the most common ones. Please speak to your financial advisor to help you make the best decision for your situation.

When to consider terminating your ILP (The Clearer Cases)

On the flip side, you should consider terminating your ILP if:

Investment-focused ILP

1. You can invest consistently yourself

If this is really just an investment vehicle with minimal insurance, and you have the discipline to invest in lower-cost alternatives consistently

2. Your funds have been consistently underperforming

If your ILP is returning 2% while global markets returned 8%, that gap compounds against you every single year. But consider switching fund first before terminating.

3. You’re comfortable with the surrender charges

When you surrender the plan prematurely, you will be charged a surrender charge. It can be quite a big sum depending on the policy. Do check it out before making a decision.

Insurance-focused ILP

1. You want an investment-focused plan

If you buy under the misconception that it is an investment-focused plan, and you want to switch to a pure investment-focused plan, terminating your ILP is a good option.

2. You want a plan with fixed insurance cost

You’re not okay with the increase insurance charges as you age. You want to terminate your ILP and get a term insurance plan instead.

3. You want certainty on keeping the plan till you’re old

If you intent to keep the plan till you’re old, you may want to reconsider the ILP. Insurance-focused ILP can get very expensive as you age, if your investment don’t generate enough return to cover the insurance cost, it may terminate prematurely.

Your Action Plan

Okay, so you’re ready to make a decision. Here’s how to actually do it step-by-step:

Step 1: Get Your Policy Documents

- Locate your benefit illustration and current statement of account

- Note your surrender table (get from your insurer if you don’t have it)

- Identify which type of ILP you have (investment-focused or insurance-focused)

Step 2: Calculate Your Surrender Value

- Check what year you’re in and what the surrender charge is

- Call your insurer and ask for an exact surrender quotation (not just an estimate)

- Note any tax implications (though typically minimal for most ILPs)

Step 3: Model Your Alternatives

- If terminating, what would you invest in? (VWRA, robo-advisor, index fund?)

- If keeping insurance, what would term insurance cost separately?

- Create a simple spreadsheet: ILP scenario vs. alternative over 10/20 years

Step 4: Review Your Insurance Needs

- What coverage do you actually need? Use the DareToFinance guidelines: 9-10x annual income for life insurance, 3-5x for critical illness

- Is your ILP providing adequate coverage, or are you underinsured?

Step 5: Make Your Decision and Act

- How to terminate your ILP: Contact your insurer with a written request (keep proof). Some insurers (e.g. Great Eastern, Manulife) allow you to terminate through their web portals, while others may require a call or physical request.

- If keeping: decide on any adjustments (fund switches, coverage changes, etc.)

- If unsure: set a review date one year from now to revisit your decision.

The Mis-Selling Reality

As of 2024, ILP complaints in Singapore hit 211 cases—nearly quadrupling from 2023. The main issue? Misselling. Many agents sold ILPs as “safe savings plans” without clearly explaining the risks, fees, and market volatility.

If you feel you were mis-sold your ILP — told it was “guaranteed,” promised high returns, or not shown the actual fee structure — you can escalate a complaint to FIDREC (Financial Industry Disputes Resolution Centre). It won’t necessarily remove your surrender charges, but it’s worth pursuing if you were really misled.

The 98 Cents Is Still Up To You

Here’s the truth: there’s no one-size-fits-all answer. Some ILPs genuinely keep people invested and protected. Others are fee-heavy and underperforming.

Don’t hold your ILP just because of surrender charges — that’s sunk cost thinking. Don’t terminate it just because Reddit says ILPs are evil — that’s herd mentality.

Instead, do the math. Understand which type you have. Compare your options. Then make the call that makes sense for your financial situation.

Because remember, our 2 cents on personal finance? The other 98 cents — that’s still up to you.