The danger of blindly following someone's investment advice

How much should you trust that content creator?

We all know the importance of investing to beat the inflation that erodes our money and hope that we no longer need to rely on our income one day. Unfortunately, researching what to invest in can be a chore; not everyone is interested in investing. For most of us, doing research can be tedious. With juggling a full-time job, many would want to use their precious time off work to devote it to something that they are not interested in. The danger comes in when we skip the research completely and simply invest in hearsay or invest in what simply “feels right”,

In this article, we look into the danger of blindly copying others’ investments and share some advice on how you can move out of the situation.

The danger of copycat investment

Accountability

It is definitely easier to invest based on a stock recommendation by YouTuber, a financial blog, or even a page like ours. The main problem is that these platforms do not owe you a single thing. When you invest in a company, you are in it for the long term. In fact, most of the time you would rather not sell your investment in the short term because that would mean that you’ve made the wrong call.

So when someone (content creator or some guy you saw on social media) recommends a stock, it could be a one-off thing. You can’t expect them to provide regular updates, let alone hold them accountable for the possible wrong information. Remember that most of them earn through audience interaction and are not incentivised to help your portfolio.

Conflict of interest

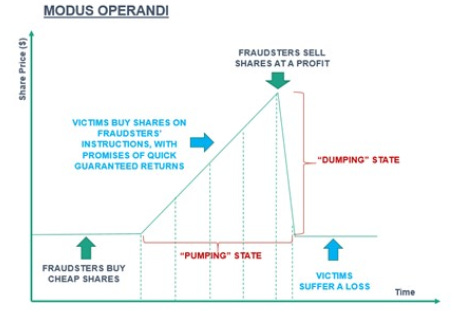

Heard of pump and dump? Pump and dump is essentially like an investment scam, where an individual hype up an investment, i.e. convincing many people to invest in one particular stock and when it reaches a high point, that’s when they exit while you absorb the losses.

Source: Singapore Police Force

Even when a content creator is giving genuine advice, they will be safeguarding their own interest first before yours. Just as withthe case of cryptocurrency Luna, where the value dropped to 0 overnight, it is likely that they would be exiting first before making a public announcement.

Feeling lost AF during the market crash

When you follow others’ investing advice, it’s like having full reliance on a tour guide. Would it be well suited to your interest in foodie spots or sightseeing? Similarly, when the recommended stock performs well, it calls for celebration, but when the stock crashes that’s when hell breaks lose.

Typically, if you do your own research you will form your own conviction about a company. If the share price drop by 50%, the first thing you would do is to find out the reason behind it. You would then compare the reason against your thesis (i.e. why you invest in the company in the first place) and see if there’s anything alarming.

But if you weren’t the one doing the research, all you would see is a 50% loss of your hard-earned money. As you can imagine, you are likely to make an emotional decision and that usually doesn’t end well.

How to get out of it?

Okay, so if you have been following others’ investment advice blindly, you have no idea why you’re investing in these stocks and they are all in red now. What do you do now? Here’s what we think is good for you, consolidate and strategize.

Consolidation

This might be a lengthy process but definitely worth your time. Take a look at the current investment that you hold. For each of them pen down what made you invest in the first place. Next, rank them according to which interest you most and the one that has the most potential. Thereafter, it’s time to remove the stocks for that you have no conviction and try to keep within what’s manageable.

Manageability is subjective. It depends on how much time and effort are you willing to put in. To some 10 to 20 stocks are manageable, for me the sweet spot is around 5. These remaining stocks that you choose to keep, are the ones that you’re most convicted with. You should have an understanding of the risk, potential, industry, competition, etc of the company you hold. On top of that, you will need to keep an eye out for any potential event that may tilt the risk in your favor, i.e. time to sell. So, with your time availability, how many stocks can you manage?

Strategise

Once you’ve made your portfolio leaner, this step is more so to plan your investment strategy ahead. Ultimately, it is about answering the question of how much of my own investment I should outsource.

If you have found that you love doing research, there might not be a need for you to outsource any. But based on the profile of the people we meet, most people feel more comfortable outsourcing their portfolio to a certain extent. Have an honest thought with yourself how much of your money are you confident to handle yourself?

Conclusion

Everyone has a different style of investment and risk appetite. But blindly following someone’s investment is something that we definitely do not encourage. After all, it adds unnecessary risk as with what we mentioned in the article. So do spend some time understanding what you’ve invested and if you do find that you are not interested in investment, there are plenty of ways to outsource them as well.