The ultimate guide to ETF

A step-by-step guide to choosing ETF and where to buy them

An exchange-traded fund(ETF) is a great investment asset. They are beginner-friendly and a great way to invest “lazily”. There are many resources out there on the internet that provide guides on how to pick a stock but when it comes to ETFs there aren’t as many.

In this article, we have compiled our past articles and hope to provide you with all the details you need to understand ETF (knowing the risk and its downside) and how to buy one you have conviction in.

What is an ETF?

ETF stands for Exchange-traded funds, which is like a basket of companies that can be traded like an individual stock. In other words, when you invest in ETFs, you invest in all the companies within the basket.

To get a deeper understanding of what is ETF, do check out this article that we wrote earlier:

Basics of ETFs

What is ETF and the pros and cons of it

Who is ETF for?

Have you ever had an intuition that a particular industry/sector would do well in the years to come? If that is the case, you might feel that it may be worthwhile to invest in a company in that area. However, in most situations, there are many companies in one industry, how do you pick the right one? Some of us may have the interest and talent in finding the right one among the gem, which can give us the highest profit.

Although being able to find the right gem can yield us the highest profit, for many reasons, we may not choose to do so. It could be the lack of time, interest, maybe knowledge in the industry or we simply do not know which is the right one. The good news is instead of trying to find the right one, we can simply pick a bunch of gems — investing in multiple companies in the same sector.

Suppose that you have a strong conviction that the Biotechnology sector will do well in years to come. You do a quick google search and realise that there are 1,008 Biotechnology companies listed on NASDAQ. Hmmm, so what’s next? Maybe you can google the top 10 Biotechnology companies and filter from there. But how do you know which company will give the best return not just this year but a decade later too? And what if, the company you are looking for isn’t even in the top 10 places?

If you do not have any knowledge about Biotechnology, there may be a steep learning curve to understand the business and a lot of potential technical terms that you have to deal with. Given that you probably have a full-time job and other things to do in life, you might not want to spend your free time doing this research. Furthermore, you will have to keep up to date with the industry news to be aware of any news that may endanger your investment goal.

If any of these feel daunting to you, that is when you might want to consider getting an ETF instead to relieve the amount of work needed for research.

On top of relieving the work needed, ETFs also help us to reduce the risk of picking the wrong company. A straightforward way to increase your chances of picking the right company in a sector is to invest in all the companies in it. But most retail investors like myself, may not have enough resources to invest in every company in a sector. That is where an ETF comes into play. An ETF helps us to split our investment across multiple companies so that we have instant diversification.

Example

Let’s visualise what we mentioned above in a concrete example with Straits Times Index (STI) ETF. Straits Times Index ETF basically is an ETF that tracks the performance of the STI. STI is a market capitalisation weighted index that tracks the performance of the top 30 companies listed on the Singapore stock exchange (SGX). It is can be seen as an indicator of how well Singapore’s economy is performing. As of 26 Apr 2022, the STI ETF is trading at SGD3.34. To invest in Singapore Exchange, the minimum number of units that needs to be traded is 100 (known as one lot). So to invest in STI ETF you would need to have at least $334 (assuming no other charges).

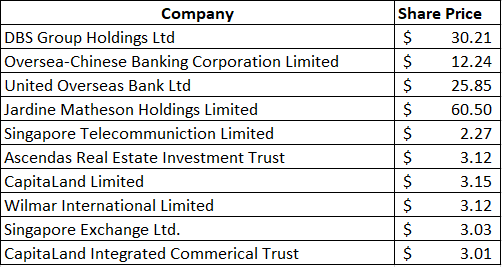

Top holdings from STI ETF(left), Top holding share price as of 03/Aug (right)

The $334 you invested in STI ETF is split among the holdings in the fund. In this case, there are a total of 30 companies that are included in the ETF. How your $334 is divided depends on the actual weightage stated in the fund factsheet. For example, the STI ETF has a 17.66% weightage in DBS, so your total amount invested in DBS with one lot would be only around $58.98. This is derived by taking the cost of one lot ($334) and multiplying by the weightage $334 x17.66%.

If you invest directly in DBS, since one share of DBS cost $30.21, you would have to buy 100 shares of it (remember the minimum share criteria of STI) so that would cost you about $300.21.

And to replicate the holdings in the STI ETF (ignoring the weightage), you would need a lot more capital to do so. Just the top 10 holdings would require at least $14,650. Therefore, for someone interested in investing in a sector/industry, but does not have enough capital to do so, ETF is a great alternative.

The different types of ETFs

ETFs mainly differ based on how the fund is managed (either actively or passively) and the investment objectives. The passively managed fund usually tracks an index or mirrors a segment of it, while the actively managed fund selects the holdings in the ETF based on its own criteria.

In general, there are:

-

Index-fund ETF. Tracks the top xx company in an economy like the example mentioned above

-

Sector-specific Index-fund ETF. Track the top xx company of a specific sector in an economy like biotechnology stocks in the US

-

Thematic ETFs. Funds are selected based on the theme, for example, Environment Sustainability Governance commonly known as ESG funds.

-

Dividend ETFs. Funds are selected based on their dividend capability.

For a more detailed understanding of the different types of ETFs mentioned above, please read this article that we posted earlier.

The different types of ETFs

What are they and what do you need to know about them

Of course, there are many more types of ETFs in the market, but these are more than enough to get you started.

The worst-case scenario for ETF?

Like many things in the world, ETFs are not the perfect investment asset, there are many ways that they can go wrong. We need to know what could go wrong so that we are mentally prepared for the worst.

In my opinion, there are two worst-case scenarios that can happen — the risk of underperforming and the risk of ETF closure. The meaning of both can be implied by the name, but if you wish to get a better understanding, I would encourage you to read an article we posted earlier.

Getting started with ETF

If this is your first time investing in an asset directly on a stock exchange, great job on taking the first step! ETF is a great stepping stone towards becoming a seasoned investor. If your end goal is to be able to select your own company to invest in, you can see ETF as a training ground for that.

To get yourself started, you can first look into ETF in which you have domain knowledge. For example, if you work in the cloud computing industry and you believe in the growth potential for this industry, you can start off by simply googling “cloud computing ETFs”. From there you will probably get a list of ETFs that has the investment objectives relevant to cloud computing. By doing this simple search, you have significantly narrowed down the number of ETF options. If you simply wish to invest in an index fund, the research that needs to be done is even lesser.

For a more detailed guide on the things to look out for when choosing an ETF, you may read this article that we wrote previously:

Conclusion

ETF is a great way to invest without spending too much time researching and doing the intensive “homework”. We hope that in this article we have provided you with enough knowledge to get started with investing.