Ways to navigating the 2024 GST hike in Singapore

Learn how to combat the GST increase in Singapore by cutting your expenses and/or increasing your income here.

As of 1 January 2024, the Goods and Services Tax (GST) rate in Singapore has been hiked from 8% to 9%.

This increase can be a major blow to many of us, especially those are already struggling due to the pandemic, persistently high inflation rates, and recent job cuts.

However, fortunately, there are many ways for us to mitigate the impact of this GST increase in Singapore.

What exactly is Goods and Services Tax (GST) in Singapore

The Goods and Services Tax (GST) is a form of taxation in Singapore on goods or services, including imports.

Only businesses with taxable turnovers of S$1 million or more must register for GST. Those with a taxable turnover below S$1 million may register for GST voluntarily.

Through GST, money flows from consumers to businesses and back to the government, which can ultimately use it to fund public projects like schools, hospitals, and roads.

How does a Goods and Services Tax (GST) hike in Singapore impact me

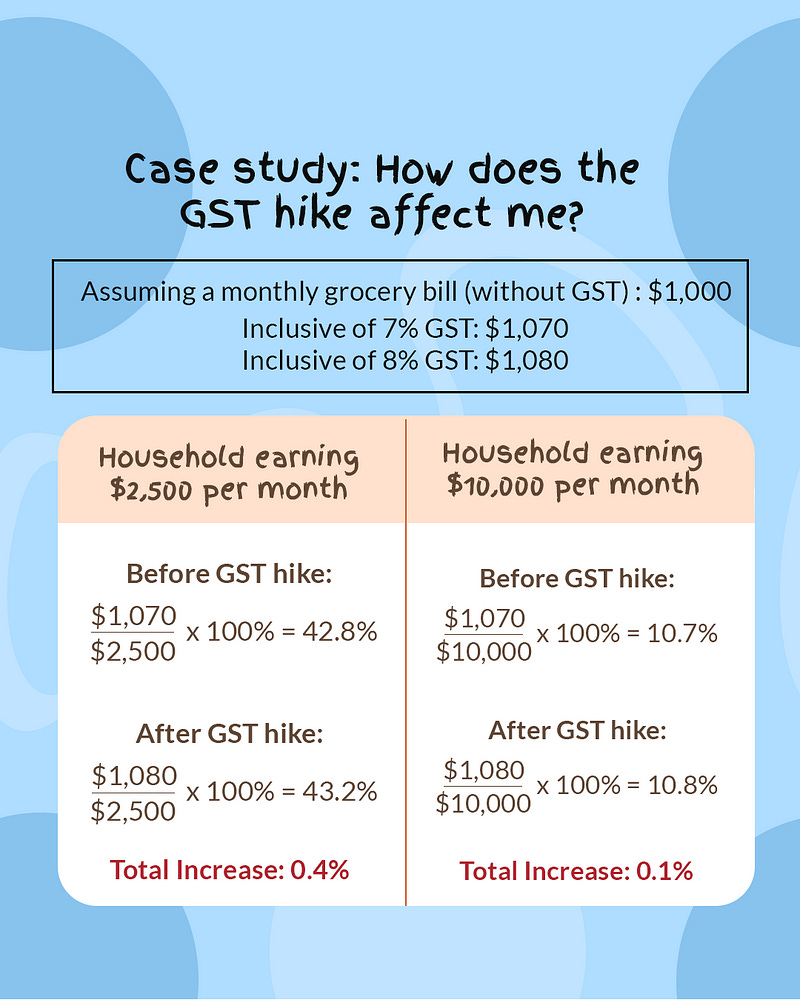

A rise in GST leads to an increase in our daily expenditure.

Lower-income groups are hit harder by this hike as a greater proportion of their income is spent on essentials than middle and high-income households.

For example, a monthly $1,000 grocery bill (without GST) will be increased from $1,080 (with 8% GST) to $1,090 (with 9% GST).

If you’re a household earning $2,500 per month in Singapore, the proportion spent on groceries will be raised from:

Before GST hike: $1,080/$2,500 * 100% = 43.2%

**After GST hike: $**1,090/$2,500 * 100% = 43.6%

43.2% to 43.6% is a 0.4% increase.

In comparison, a household earning $10,000 in Singapore will see the proportion rise from:

Before GST hike: $1,080/$10,000 * 100% = 10.8%

After GST hike: $1,090/$10,000 * 100% = 10.9%

10.8% to 10.9% is a mere 0.1% increase.

Though the percentages seem small, the prices will only continue to rise further and the differences add up over the years.

Ways to mitigate the Goods and Services Tax (GST) increase in Singapore

There are two main ways to protect yourself against rising prices in Singapore–reduce your expenses or increase your income.

How To Reduce Expenses

First, begin by reviewing your expenses on a regular basis so that you can identify areas where costs can be reduced.

Next, consider the following methods:

1. Cut back on non-essential products and services

Before you buy anything, think about the value it brings to the table. If it doesn’t add real value, don’t spend money on it.

Opt to scale back meals out at restaurants and instead cook more meals at home. Alternatively, you can also switch mobile phone plans as well as cable or internet packages that offer cheaper rates and fewer features.

2. Shop smart

If you’re not a fan of cutting back your spending, consider shopping smart to snag the best deals possible.

-

Look for discounts available for the items you are buying;

-

Purchase in bulk for greater savings;

-

Shop online since online retailers often offer lower prices than brick-and-mortar stores due to lower overhead costs;

-

Switch to household brands for cheaper products;

-

Buy preloved items on Carousell or Facebook Marketplace to get items at a fraction of the original prices or sometimes even free, with the added benefit of being eco-friendly;

-

Take advantage of the better currency rates across the border to cut costs, and

-

Use cashback cards to receive a portion of your spending back

How To Increase Income

Other than cutting expenses, another way of mitigating the effect of a GST hike in Singapore is by increasing your income.

1. Take up more part-time or freelance jobs

If your full-time job isn’t paying enough to keep up with the rising costs of living, consider an extra part-time job or even starting a side hustle. This could be anything from freelance writing and graphic design to pet sitting and home cleaning services. You can find plenty of freelance opportunities online that match your skill sets on platforms such as Fiverr and Upwork.

2. Negotiate your salary

Another way to increase your income is to simply ask! Don’t be afraid to negotiate your salary if you feel like it is too low for the work that you do. Research similar positions in your industry and use those figures as negotiation points when talking with your employer about an increase in pay. Don’t be afraid to fight for what you are worth — it could mean more money coming into your pocket each month!

3. Apply for government aid

Take advantage of all available financial aid provided by the government and community agencies in Singapore. Researching and applying for them if eligible can provide some needed relief and assistance during these trying times.

Try out SupportGoWhere, a fuss-free, one-stop online resource portal to find support schemes and services with ease. Simply fill in a short questionnaire and you can immediately find out which grants you’re eligible for.

Be prepared for the Goods and Services Tax (GST) hike in Singapore

From the pandemic to the increasing costs of living like the GST hike, there are a lot of things beyond your control. However, taking charge of your finances is one way to ensure that you’re still able to live comfortably despite rising prices.

Start making sound financial decisions today so you can reap more benefits tomorrow!