Why you might not want to all-in on S&P 500 investment

The underlying risk of the S&P 500

If you’ve embarked on your investment journey or perhaps even just started, you would have heard of S&P 500 index. The S&P 500 tracks the 500 biggest companies listed on the United States stock exchange.

S&P 500 is a popular investment, in fact, there are many pieces of advice that suggest simply investing in S&P 500 as though it is a no-brainer. Some even go to the extent of stating that that’s all you need. In this article, we will highlight some of the risks of S&P 500 that you should be aware of before putting in any of your hard-earned money.

Currency Risk

One of the more obvious risks is currency risk. In other words, your investment return is also impacted by the valuation of USD against SGD. Even if the index does extremely well, if the USD were to depreciate or if SGD were to appreciate, it would impact your returns directly. If you look at the period from 2003 to 2022, the USD to SGD had fallen by 18.34%.

United States Dollar to Singapore Dollar

But of course, the reverse would work in your favor too. If the USD were to appreciate, your return on investment would be higher too.

If you want to find out more about some of the risks of the U.S dollar, do check out this youtube video:

Estate Risk

Here’s one risk that’s lesser known to many people. All US stocks are subjected to estate tax. An estate tax is a tax imposed on assets before it is passed on to anyone. This means that if you were ever to pass on, your asset would be taxed before it is passed to your beneficiaries.

This includes all your US-domiciled S&P 500 ETFs such as VOO, SPY, etc. The tax is tiered, depending on the total amount of assets. It starts from 18% and goes all the way up to 40%. If you have a total of $1 million assets in the US, should you pass on, you will essentially be paying close to $400k in tax. That’s quite a shockingly big amount.

So if you’re heavily invested in the US market, do be mindful of this and take the necessary measures to insure yourself against this risk.

Concentration Risk

If you think S&P 500 is well-diversified, hold on to that thought.

Firstly, S&P 500 only tracks top companies that are listed on the United States exchange. To be exact, for a company to qualify for the index, one of the main criteria is to be based in the US.

Secondly, having 500 companies doesn’t necessarily mean it is all weather. In fact, if you dive deeper and focus on the time period between January 2000 to December 2009, you will realize that the annualized return for these 9 years is -0.95%. Yes, holding on to S&P 500 for 9 years does not guarantee you a return. This came as a shock to almost everyone that we spoke to, after all, many have been brainwashed that as long as you buy and hold long enough, you will be rewarded. Sure enough that the S&P 500 climbed to multiple record highs after 2009, but how many cycles of 9 years can you afford to wait for?

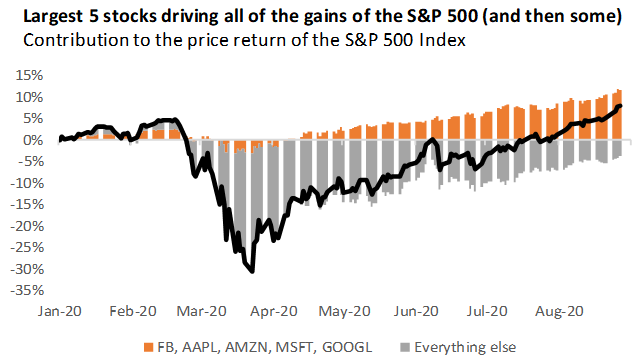

Heavy weighted on the top companies The S&P is a float-weighted index, what this means is that the bigger the company, the more impact it will have on the index. And when more money is poured into the index, it will further aggravate this reliance. Because of that, you are actually reliant on the top holdings and not so much on all 500 companies. In fact, the top 5 stocks (Apple, Microsoft, Amazon, Facebook and Alphabet) drove the entirety of the gains of the S&P 500 in the year 2020, outweighing the remaining 400 companies.

Although the chart above shows data in 2020, it hasn’t changed much either. Despite the top 5 companies changing, it still takes up 20% weightage of the entire S&P 500 as of August 31

Having such concentration at the top isn’t necessarily bad, but the problem is the lack of awareness—many of the people we spoke to don’t know that the S&P 500 is weighted and have a false impression that it accurately represents the performance of all 500 companies.

Now that you know this, when you are invested in S&P 500, you are placing a big bet on the top companies, which are essentially the tech companies.

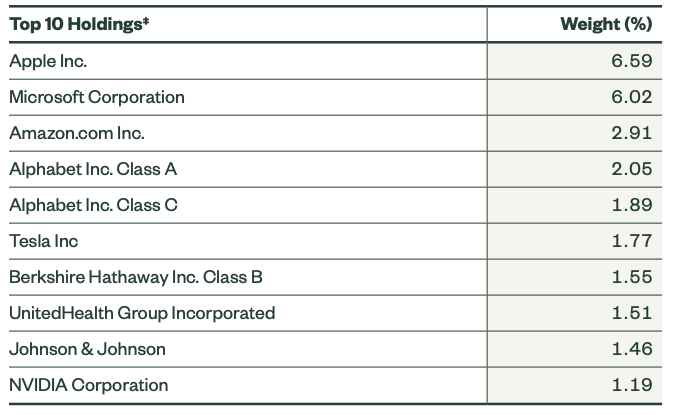

source: SPY Fund Factsheet

As you can see, the largest holding, Apple, has almost 6x as much weightage as the 10th largest holding, NVIDIA.

Conclusion

Regardless of what asset you invest in, there would be risk associated with it. Just because it is a popular choice does not necessarily mean that it is risk-free. Always do your own research while being open-minded to others’ opinions. At the end of the day, no body will care more about your money than you do.