What The New Integrated Shield Plan Rider Changes Mean For You (And Your Wallet)

Major changes to IP riders are coming in April 2026—here's how it affects your healthcare coverage and premiums

If you’ve been paying attention to the news (or your insurance agent has been blowing up your phone), you’ve probably heard about the big shake-up coming to Integrated Shield Plan (IP) riders. And if you’re like most Singaporeans with private health insurance, you’re probably wondering: “Wait, what does this mean for me?”

Deep breath. We’re here to break it down in plain English—no insurance jargon, no confusing fine print. Just the facts you need to know about how your healthcare coverage is about to change, and more importantly, what it means for your wallet.

The Big Picture: Why Is MOH Doing This?

Let’s start with the elephant in the room. On November 26, 2025, the Ministry of Health (MOH) dropped a bombshell announcement: starting April 1, 2026, all new IP riders will come with major changes.

But why? Well, Singapore’s private healthcare system has been caught in what Health Minister Ong Ye Kung calls a “knot”—and it’s getting tighter by the year.[1]

Here’s the problem in a nutshell:

- Private hospital bills are skyrocketing. The median bill jumped from $9,100 in 2019 to $15,700 in 2024—that’s a whopping 72% increase in just five years.[2]

- Insurance claims are through the roof. People with riders are 1.4 times more likely to make a claim, and their claims are 1.4 times larger than those without riders.[3]

- Insurers are bleeding money. In 2024, four out of seven IP insurers reported losses between 9% to 48%, while the remaining three barely broke even.[4]

- Your premiums keep climbing. IP rider premiums grew at 17.2% annually from 2021 to 2024—more than double the growth rate of the base IP premiums.[5]

The result? A vicious cycle where everyone loses. Policyholders pay higher premiums with more restrictions, doctors face cumbersome claims processes, hospitals struggle with pre-authorization requirements, and insurers can’t stay afloat.

MOH’s solution? Reset the system by making sure insurance does what it’s supposed to do—protect you against catastrophic bills, not cover every last dollar.

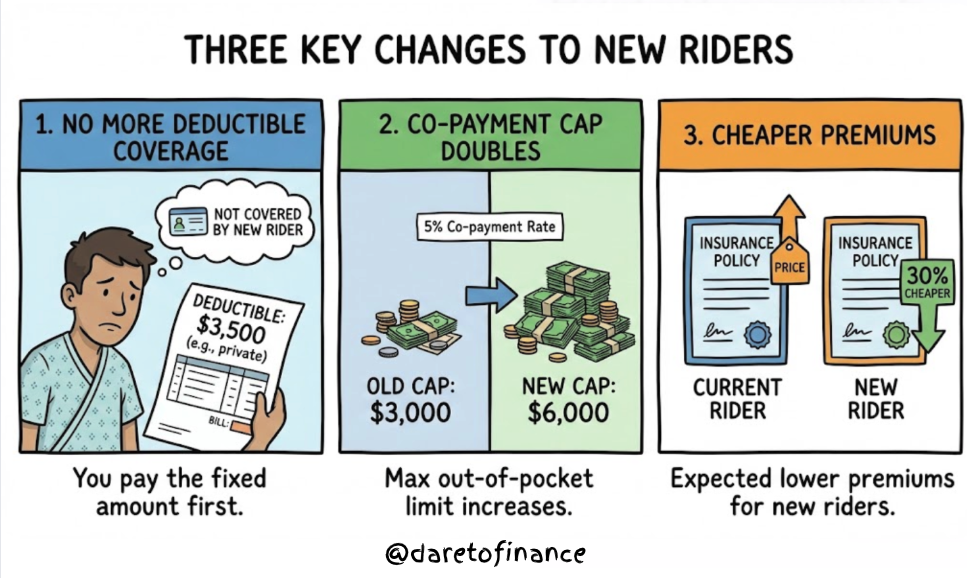

What’s Actually Changing? The Breakdown

Alright, let’s get into the nitty-gritty. Here are the two major changes coming to IP riders:

Change #1: New Riders Won’t Cover Your Deductible Anymore

What’s a deductible? It’s the fixed amount you have to fork out each year before your insurance kicks in (learn more in our essential insurance guide). For private hospital coverage, this is typically $3,500 for those under 81 years old.[6]

Before April 2026: Your rider would cover this deductible, meaning you’d effectively pay nothing upfront (or could use MediSave for just the 5% co-payment).

From April 2026: You’ll need to pay the full deductible yourself. The good news? You can use your MediSave to pay for it.

Change #2: Co-Payment Cap Doubles from $3,000 to $6,000

Currently, riders cap your annual co-payment at a minimum of $3,000. This means even if you rack up huge bills, the most you’d pay (besides the deductible, which your old rider covered) was $3,000.[7]

From April 2026: This cap doubles to $6,000 per year for new riders. You’ll still pay the same 5% co-payment rate, but your maximum out-of-pocket amount goes up.

The Silver Lining: Cheaper Premiums

Here’s the trade-off: new riders are expected to be about 30% cheaper than current ones offering maximum coverage.[8]

That translates to:

- ~$600 in annual savings for private hospital rider policyholders

- ~$200 in annual savings for public hospital rider policyholders

Quick Comparison: Old vs New Riders

| Feature | Current Riders | New Riders (Apr 2026) |

|---|---|---|

| Deductible Coverage | ✓ Rider covers it | ✗ You pay (can use MediSave) |

| Co-payment Rate | 5% of bill | 5% of bill (unchanged) |

| Co-payment Cap | $3,000 minimum | $6,000 minimum |

| MediSave Usage | For co-payment only | For deductible + co-payment |

| Premium Cost | Higher | ~30% cheaper |

| Annual Savings | — | ~$600 (private) / ~$200 (public) |

What This Means For YOU: Real-World Scenarios

Okay, theory is great, but let’s talk real money. How will these changes actually affect you when you need to make a claim? We’ve crunched the numbers for three common scenarios.

Scenario 1: Sarah’s Minor Day Surgery ($8,000 bill)

Sarah, 35, needs a minor outpatient procedure at a private hospital. Her total bill comes to $8,000.

With her CURRENT rider (before April 2026):

- Deductible: Covered by rider ✓

- Co-payment (5%): $400, but her rider covers $175 of it

- What Sarah pays: $225 (can use MediSave)

- Out-of-pocket cash: $0

With the NEW rider (from April 2026):

- Deductible: $3,500 (Sarah must pay, can use MediSave)

- Co-payment (5%): $400

- Total before MediSave: $3,900

- Out-of-pocket cash: $0 (assuming sufficient MediSave)

The difference: Sarah pays $3,675 MORE for this claim. BUT she saves $600/year in premiums (actual savings can differ from insurers).

The math: If Sarah doesn’t get hospitalized for about 6 years, she’d actually come out ahead with the cheaper premiums. But if she needs treatment every year or two, she’d pay more overall.

Scenario 2: Marcus’s Major Surgery ($56,900 bill)

Marcus, 42, undergoes a complex procedure requiring several days in a private hospital. His bill hits $100,000.

With his CURRENT rider:

- Deductible: Covered by rider ✓

- Co-payment (5%): $4,825 (hits the $3,000 cap)

- What Marcus pays: $3,000 (can use MediSave, if within medisave limits)

- Out-of-pocket cash: $0

With the NEW rider:

- Deductible: $3,500 (Marcus must pay)

- Co-payment (5%): $4,825

- Total before MediSave: $8,325

- Out-of-pocket cash: $0 (assuming sufficient MediSave)

The difference: Marcus pays $5,325 MORE (essentially the deductible amount). But again, he saves $600/year in premiums.

Scenario 3: Priya’s Public Hospital Stay ($15,000 bill)

Priya, 38, has a routine procedure at a public hospital B1 ward. Her total bill is $15,000.

With her CURRENT rider:

- Co-payment after deductible and coverage: $650

With the NEW rider:

- Deductible: $2,000

- Co-payment: $650

- Total before MediSave: $2,650

The difference: Priya pays $2,000 MORE. Her premium savings? $200/year.

For You, For Me: What Does This Really Mean?

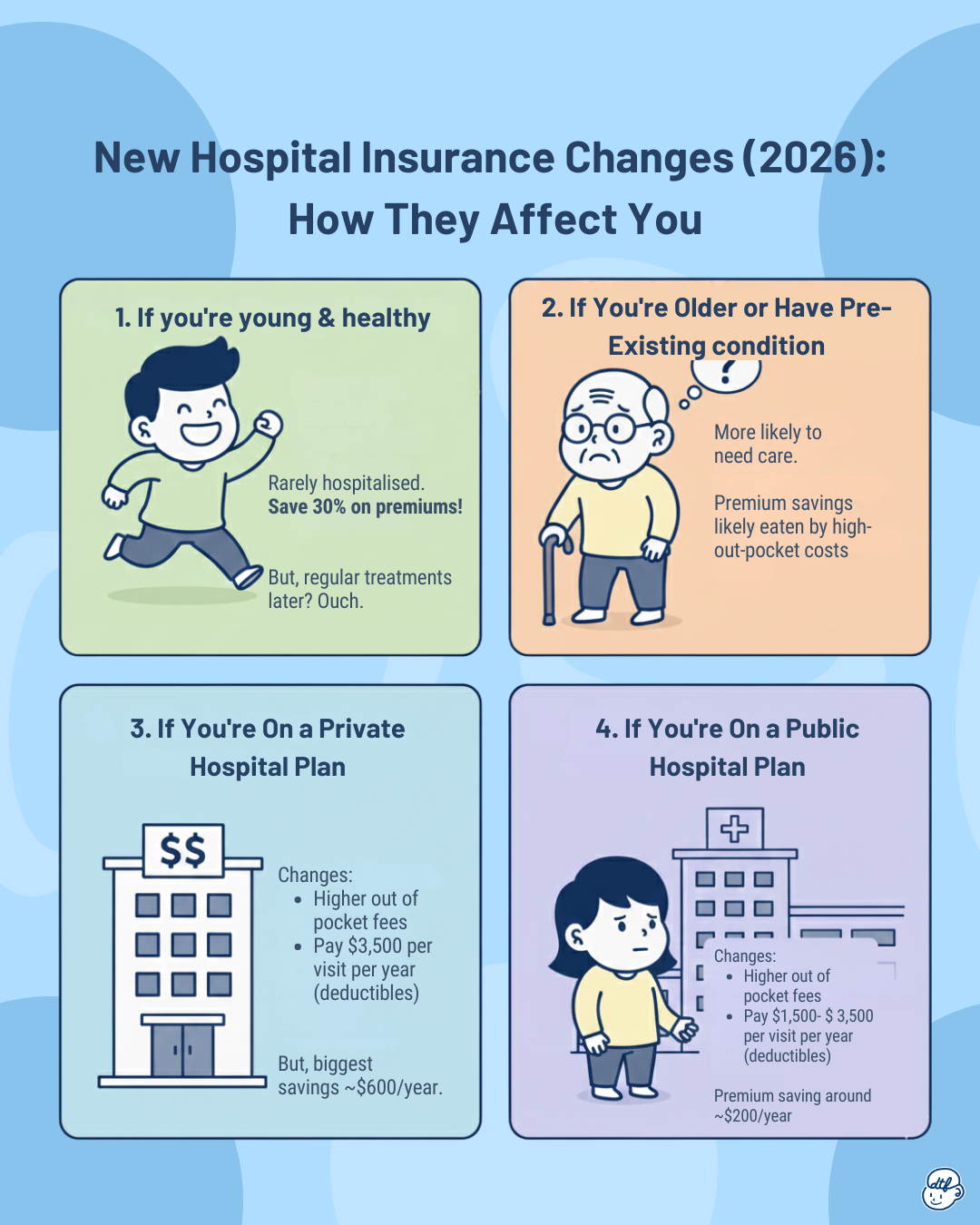

If You’re Young and Healthy

For you: This might actually be a good deal. If you rarely see the inside of a hospital, paying 30% less in premiums every year is a solid win. That $600 annual saving on private hospital riders adds up to $6,000 over 10 years—more than one deductible payment.

The catch: If you develop a chronic condition later or need regular treatments, you’ll feel the pinch on every claim each year.

If You’re Older or Have Pre-Existing Conditions

For you: This is trickier. Older policyholders are more likely to need medical care, which means more frequent deductible payments. Your premium savings might be quickly eaten up by higher out-of-pocket costs per claim.

Silver lining: About 60% of claimants won’t need to pay anything in cash—MediSave limits are enough to cover both deductibles and co-payments. Another 30% will pay less than $1,000 after MediSave.[9]

If You’re On a Private Hospital Plan

For you: You’re looking at the biggest changes. Private hospital bills are higher, which means your 5% co-payment and deductible will hit harder. But you also get the biggest premium savings—$600/year.

If You’re On a Public Hospital Plan

The impact is more moderate. Your bills are generally lower, so even with the new deductible, your total out-of-pocket won’t skyrocket. And your premium savings, while smaller at $200/year, still add up over time.

Our thoughts

Personally? I think this is MOH’s way of saying, “Insurance isn’t supposed to be a free pass to overconsume healthcare.” And honestly, we get it. When someone else is paying almost the entire bill, there’s less incentive to ask, “Do I really need to stay an extra day?” or “Is this test absolutely necessary?”

But here’s our concern: healthcare shouldn’t be a financial game of chance. For those with chronic conditions or those who genuinely need regular medical care, the new system could feel punishing. Yes, MediSave can cover a lot, but not everyone has a flush MediSave account—especially younger folks or those who’ve already dipped into it for previous treatments. Although, the transition timeline does offer protection—existing policyholders can keep their current full-deductible riders until at least 2028 without additional underwriting. What happens after April 2028 remains unclear, as insurers are still studying whether and how to adjust existing riders.

Is Integrated Shield Plan rider still worth it?

If it’s within your budget, an Integrated Shield Plan rider is still worth considering because it acts as a ceiling on how much you’ll ever have to pay out of pocket each year—even under the new rules where you must first clear the deductible and then co-pay 5% of the bill, the rider steps in to cap that 5% at a fixed maximum (now at least $6,000), so you’re protected from truly runaway hospital bills and can plan your worst-case cash or MediSave exposure with much more certainty.

When Do These Changes Take Effect? Your Timeline

Here’s what you need to know about the rollout:

November 27, 2025 – March 31, 2026: Transition Period

- You can still buy old riders, BUT insurers must inform you that your policy will switch to the new framework at your next renewal after April 1, 2028.[6]

- Think carefully before buying an old rider now—you’ll only have it for a maximum of ~2.5 years.

April 1, 2026: D-Day

- All new riders sold must comply with the new requirements. Insurers stop selling old riders.[8]

- If you buy a rider from this date onward, it’ll be under the new rules.

April 1, 2028: Mandatory Switch for Transition Buyers

- If you bought an old rider between Nov 27, 2025 and Mar 31, 2026, you MUST switch to a new rider when your policy renews after this date.

For Existing Policyholders (bought before Nov 27, 2025):

- The situation is still TBD. Insurers will “further study” their approach.[7]

- MOH encourages you to consult your financial adviser about whether new riders better suit your needs.

Need unbiased professional advice?

Our advisors are not tied to any insurer, allowing us to provide unbiased advice on whether the new riders suit your needs.

- Some insurers may keep your old rider terms, but this could slow down the system-wide impact MOH is hoping for.

The Numbers Don’t Lie: Why This Change Was Inevitable

Let’s zoom out for a second and look at the bigger picture. MOH didn’t pull these changes out of thin air—the data is pretty damning:

The Healthcare Cost Spiral:

- Singapore’s government healthcare expenditure ballooned from $9 billion in 2015 to $18 billion in 2024. It’s projected to hit $30 billion by 2030.[10]

- Private hospital median bills grew 11.5% annually from 2019 to 2024.[10]

The Insurance Industry Crisis:

- IP rider premiums grew at 17.2% per year (2021-2024).[5]

- 71% of Singapore residents (~3 million people) have IPs. 67% of IP holders (~2 million people) have riders. Of those with private hospital IPs, 80% have riders.[9]

- People with riders are 1.4x more likely to make claims. Their average claim size is 1.4x higher ($14,300 vs $10,200).[3]

The Overconsumption Problem:

- Minimal co-payments encourage “use more than is necessary”—health minister Ong Ye Kung’s words, not ours.[1]

The Insurer Losses:

- 4 out of 7 insurers reported losses of 9-48% in 2024. The remaining 3 barely broke even.[4]

- Six insurers raised premiums in 2025 despite the losses.[5]

The system was unsustainable. Something had to give.

What Should You Do Right Now?

Okay, enough doom and gloom. Here’s your action plan:

1. Talk to Your Financial Adviser

If you bought your rider before November 27, 2025, your insurer will eventually decide what to do with your policy. Schedule a chat with your FA to:

- Understand your insurer’s approach

- Assess whether switching to a new rider makes sense

- Explore alternatives (like public hospital plans or self-insurance)

2. Consider Downgrading to Public Hospital Coverage

If you’re comfortable with public hospital B1 or A wards, you might not need that pricey private hospital rider. Public hospitals in Singapore offer world-class care, and with government subsidies, your bills—and your IP costs—would be significantly lower.[11]

3. Build an Emergency Fund

With higher potential out-of-pocket costs (even if covered by MediSave), having a cash buffer is smart. Aim for at least $10,000-$15,000 in liquid savings for medical emergencies, separate from your regular emergency fund.

The Bigger Question: Is Private Healthcare Worth It?

Here’s the uncomfortable truth that MOH is dancing around: private healthcare in Singapore is expensive, and getting more expensive every year.

The median private hospital bill has grown faster than medical inflation. Fee benchmarks have helped slow the growth of doctor fees, but hospital charges, consumables, and implants are still climbing. Even with insurance, private healthcare is increasingly a luxury.

So ask yourself:

- Do you NEED private hospital coverage? Or is it a “nice-to-have”?

- Are you willing to pay 30% less in premiums in exchange for higher per-claim costs?

- Could you be just as happy in a public hospital A or B1 ward, with substantially lower bills?

There’s no judgment here. Some people value the hotel-like amenities and shorter wait times of private hospitals. Others are perfectly fine with public healthcare and would rather save the premium dollars. Both choices are valid—just make sure YOUR choice aligns with YOUR priorities and budget.

Final Thoughts: Insurance is Shifting Back to Its Roots

At the end of the day, these changes are about returning insurance to its original purpose: protecting you from catastrophic bills that could wipe out your savings, not covering every single medical expense.

Is it frustrating that your rider will cover less? Sure. Will some people pay more out-of-pocket when they need care? Absolutely. But the alternative—unsustainable premium increases, insurers exiting the market, and a healthcare system on the brink—isn’t exactly better.

The good news? You’re not powerless. You can:

- Choose coverage that fits your actual needs (not what sounds good on paper)

- Build up your MediSave and emergency fund

- Make informed decisions about where you seek treatment

- Advocate for yourself when discussing treatment plans with doctors

And hey, if the premium savings mean you have an extra $600 a year to invest, travel, or just enjoy life—maybe that’s not such a bad trade-off, especially if you’re young and healthy.

Key Takeaways

✓ New riders from April 2026 won’t cover deductibles and will have a $6,000 co-payment cap (up from $3,000)[6]

✓ Premiums will be ~30% cheaper—about $600/year savings for private riders, $200/year for public[8]

✓ 60% of claimants won’t pay cash—MediSave will cover everything[9]

✓ Do the math for YOUR situation—savings vs. out-of-pocket costs will vary based on your health and claims history

✓ Existing policyholders Consult FAs about what happens to their policies

✓ Consider alternatives—public hospital coverage might be enough for your needs

Stay Informed, Stay Covered

These IP rider changes are just one part of the bigger conversation about healthcare sustainability in Singapore. MOH is also expanding fee benchmarks, taking action against overcharging doctors, and even exploring a not-for-profit private hospital.[11]

The healthcare landscape is shifting. The best thing you can do? Stay informed, review your coverage regularly, and make sure your insurance actually serves YOUR needs—not just what everyone else is buying.

Got questions about your own IP and rider situation? Don’t wait until April 2026 to figure it out. Talk to your financial adviser now, run the numbers, and make a plan. Your future self (and your wallet) will thank you.

At DareToFinance, we break down complex financial topics into bite-sized, actionable insights. Because personal finance shouldn’t feel like rocket science. Want more real-talk money advice? Follow us on Instagram @daretofinance for daily tips, or check out our other guides on everything from insurance to investing.

Disclaimer: This article is for educational purposes only and shouldn’t be considered personalized financial advice. Your insurance needs depend on your unique circumstances—always consult a licensed financial adviser before making decisions about your coverage.

References

- Straits Times - Ong Ye Kung: Private insurers and hospitals all tied up in a ‘knot’, MOH helping to untie the knot

- Business Times - IP rider changes: Yet another stab at dampening claims and improving insurers’ results

- CNA - The Big Read: Insurance, healthcare over-consumption and premiums

- Business Times - Surge in claims drags some Integrated Shield insurers into red, higher premiums expected

- Straits Times - S’pore’s MOH moves to stamp out costly health insurance riders that confer ‘absolute peace of mind’

- CNA - Integrated Shield Plan rider co-payment cap, deductibles and MediSave coverage

- CNA - Changes to Integrated Shield Plan riders FAQ

- MOH - New requirements for Integrated Shield Plan riders to strengthen sustainability of private health insurance and address rising healthcare costs

- CNA - MediSave limits enough to cover deductibles for 60% of claimants

- Singapore Medical Association - Healthcare Expenditure Report 2024

- CNA - Ong Ye Kung on MOH health private hospital benchmarks